ATLANTA – Governments in several areas have started to ease quarantine orders, according to a recent ECIA survey. However, conflict between governments, citizens and businesses has resulted in some localized turbulence. A sense of urgency to reopen the economy continues to build, and additional funding has been approved after the initial round of funding to support businesses, especially small businesses, was exhausted quickly.

Common expectations continue to point to a deep and extended economic crisis, as GDP reports reveal the painful impact of this pandemic on major economies around the world.

The survey was conducted between Apr. 28 and May 5.

Expectations for end-market demand and confidence in bookings backlogs continue to be somewhat inconsistent, ECIA found. Consumer electronics outlooks did improve significantly since the last survey. However, more than half of the industrial and automotive electronics forecasts suggest a decline in market demand. Weak to very weak confidence in automotive backlog is reported by 53% of respondents. Industrial and defense/aerospace see 22% and 21% sharing concern about weak bookings. The industrial and A&D markets project strong to very strong confidence on order backlogs, however, at 43% and 42%, respectively.

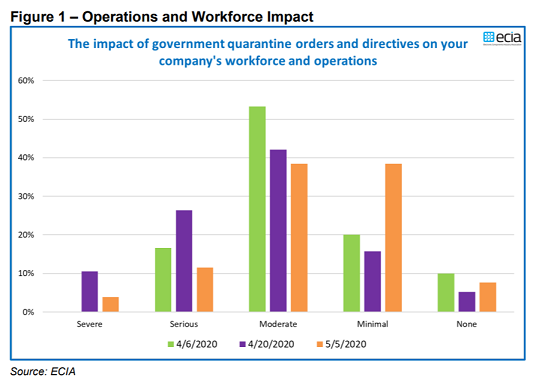

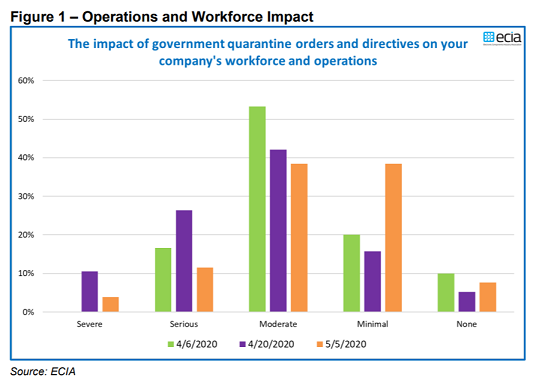

Medical electronics demand/confidence continues to reflect expectations for a strong increase. The latest results on the question about the impact of government quarantine orders on a company's workforce and operations show an encouraging decrease in disruption. Only 16% report a serious or severe disruption. By contrast, 46% now see minimal to no impact on their operations or workforce.

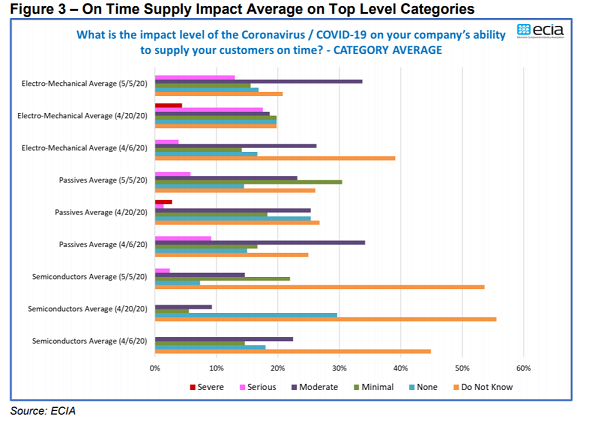

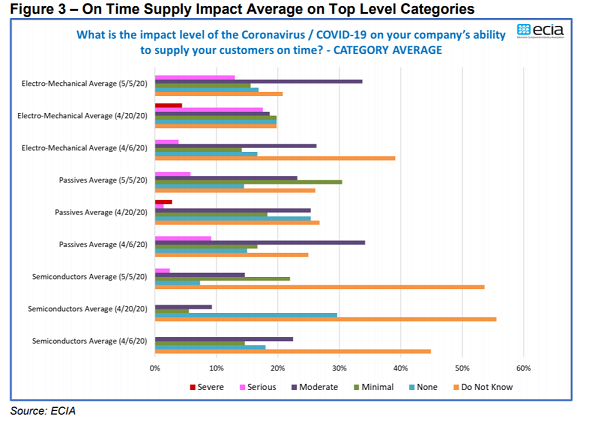

The indexes in the latest report show a modest increase concern over on-time deliveries to component customers. The index summarizing end-market demand expectations shows automotive electronics markets continuing to slide – falling below 15%. Consumer electronics and industrial electronics improved slightly to 38%. The overall index stayed relatively constant at 46%. The index measuring overall lead-time increase expectations saw improvements in electromechanical and passive components, while semiconductors jumped up. As noted previously, the supply chain impact index saw reduced concern in every area except raw material supply, which reversed the improvements it saw in the last survey.