2023 saw only a handful of fabricators gain ground, but SE Asia is primed to boom.

Small it was, but the Thailand Electronics Circuit Asia exhibition held in Bangkok in late July was extremely informative as to what is happening in the Southeast Asian nation. According to the Thailand Board of Investment (BOI), the PCB output in Thailand may become the third or even second largest in the world. From 2022 to 2026, about $6 billion to $7 billion will be invested in PCB capacity in Thailand (at this moment, 40-plus fabricators from Taiwan and China are pouring into Thailand). Calling Thailand the second-largest PCB-producing country may be a bit of a stretch, but the third largest is not an exaggeration. From the view of “nationality,” however, Thailand-based KCE and a few other small ones will account for less than 10% of the total output. Taiwan-, China- and Japan-based companies will hold the lion’s share of the PCB output in Thailand.

The author wrote this report at Bangkok International Airport while waiting for a flight to Penang, Malaysia, where he was scheduled to visit several PCB fabricators before returning to Bangkok. He was then planning to visit 10 new PCB plants in Thailand before heading home to New York.

Thailand is just the latest in a string of geographical disruptions to the printed circuit manufacturing landscape over the past three decades. What was once the provenance of Japan and the US gave way to Taiwan, China, Vietnam and now Thailand as major hubs of production. But is it reflected (yet) in the latest NTI-100 rankings of the largest printed circuit board manufacturers?

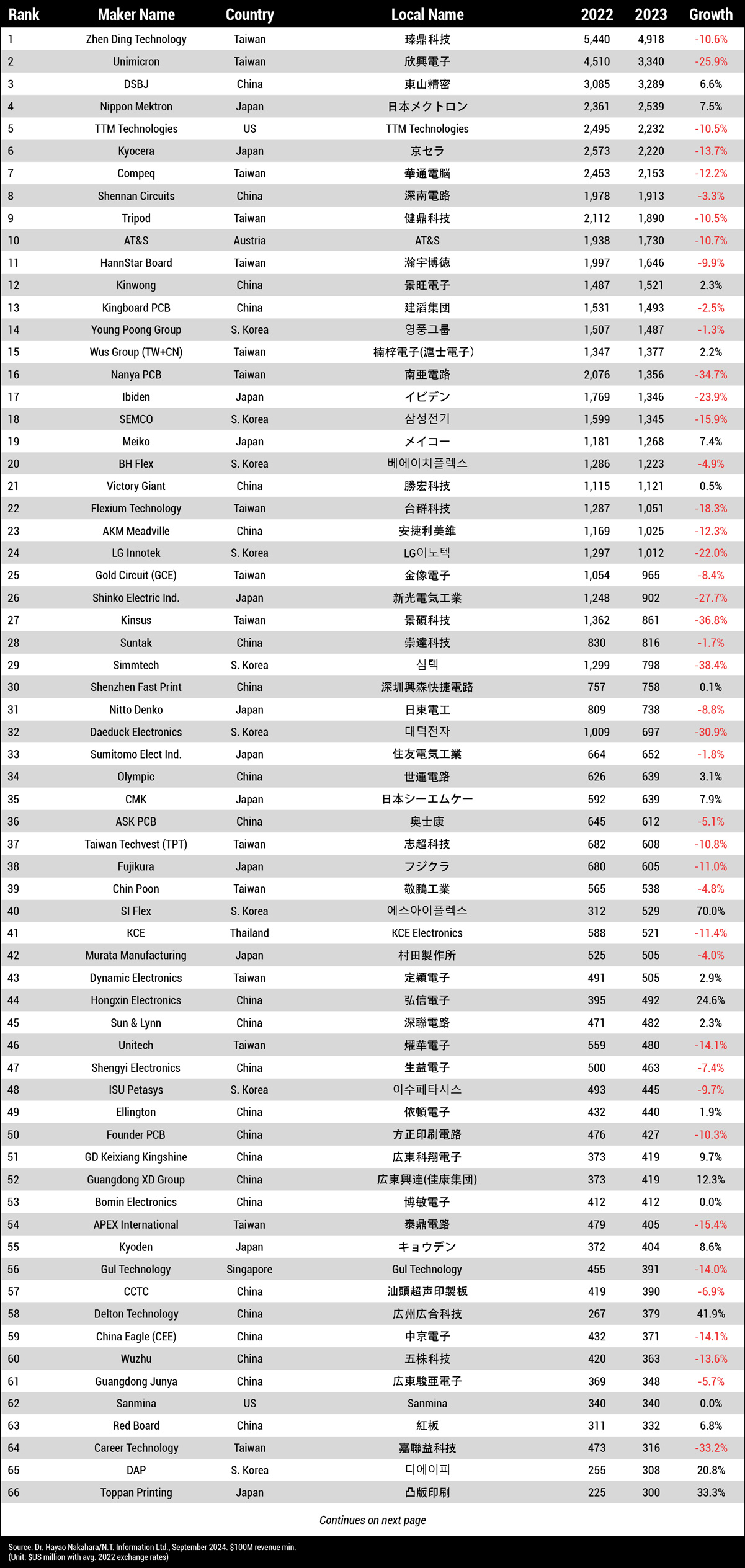

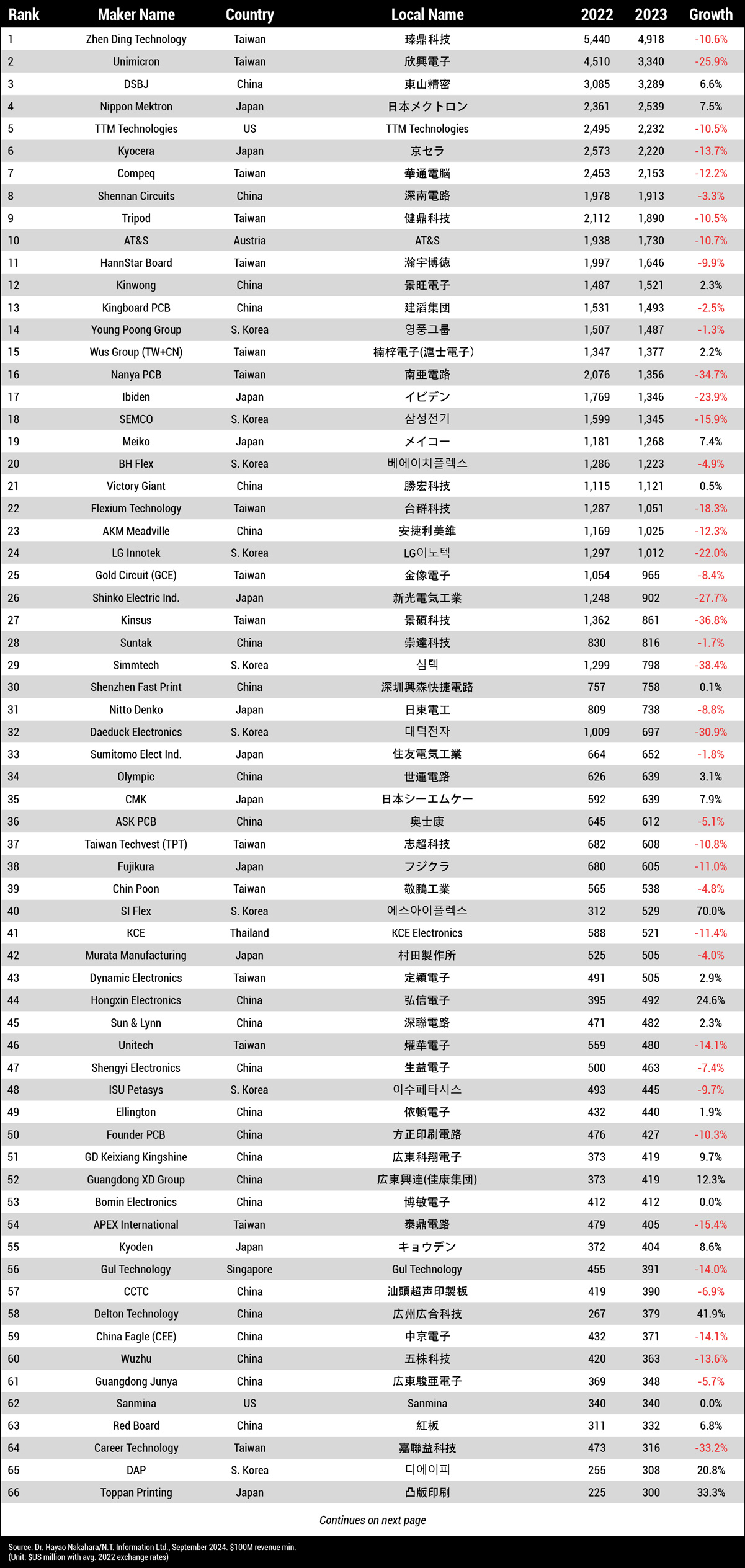

The annual NTI-100 list attempts to ascertain just that. The author looks at the growth of manufacturers with revenues of $100 million or more. He also provides a look at the overall PCB market and how those companies – which now number 134 – fit within the global picture.

Obtaining the printed circuit board output from top fabricators is not so difficult if they are publicly traded, although public companies in China and South Korea pose a challenge because their financial statements are often blurred. Then, many manufacturers whose outputs are presumably more than $100 million per annum are privately owned and normally do not publicly disclose their financial status. Finding the specific PCB revenues of some large companies is not easy either; Sanmina and Amphenol, for example. As such, the author must make certain assumptions and guesses.

Table 1. NTI-100 Largest PCB Fabricators, 2023

The NTI-100 list uses the US dollar as the baseline currency. Exchange rate volatility, then, can affect the rankings. For instance, the declining exchange rate of the yen against the US dollar toppled Japanese fabricators from their previous positions. From 2000 to 2018, the average yen to dollar value was ¥110:$1. In 2023, the average yen value rose to 142. Therefore, using, say, the 2015 exchange rate, the Japanese fabricators’ output would have been 30% higher and their relative rankings would rise accordingly with the increase. Exchange rates are beyond the author’s control. (At the time of this writing, the exchange rate is ¥156:$1, which is drawing more tourists to Japan than before the Covid pandemic.)

Along with the 2023 NTI-100 list, the 2022 rankings are provided for comparison (2022 revenues were converted using 2023 exchange rates). This year, no analysis such as the number of entries by nationality, etc., is provided. Sorry. Readers can make their own assessments. Roughly speaking, the fabricators in Taiwan, China, Japan and South Korea have the lion’s share (more than 90%).

Exchange Rates

As noted, the Japanese yen lost value in 2023, and is still dropping (Table 2). (Now ¥142:$1, like a yo-yo.) Financial experts claim the Japanese government kept its zero-interest rate policy too long while other major countries increased their interest rates; this, they say, is one of the major reasons for the slippage. When the author traveled to Japan in June bringing US dollars, goods seemed much less expensive compared to a few years ago.

Table 2. Average Exchange Rates, Local Currency/USD

Ceramic Circuits

Readers will notice that the output of Kyocera jumped from 2022 with the inclusion of its ceramic package substrate output. NTK is a new entry. The inclusion of ceramic circuits is in preparation for glass substrates in the future. The author regrets his inability to search for other ceramic circuit fabricators which might otherwise qualify for the NTI-100. The list, therefore, is not as accurate as the author wishes.

2023 Considerations

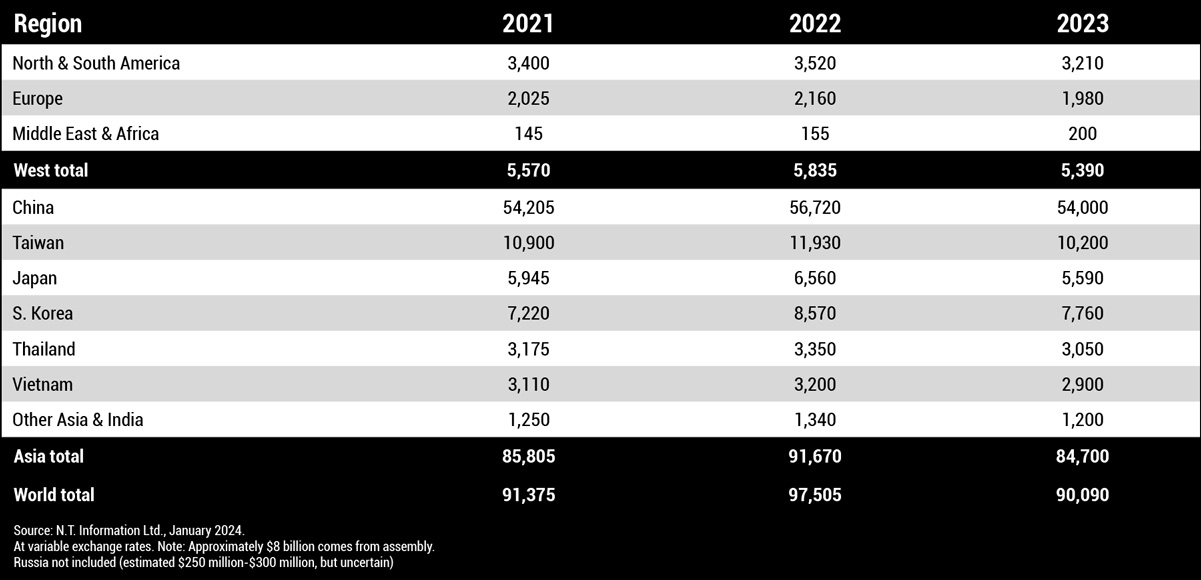

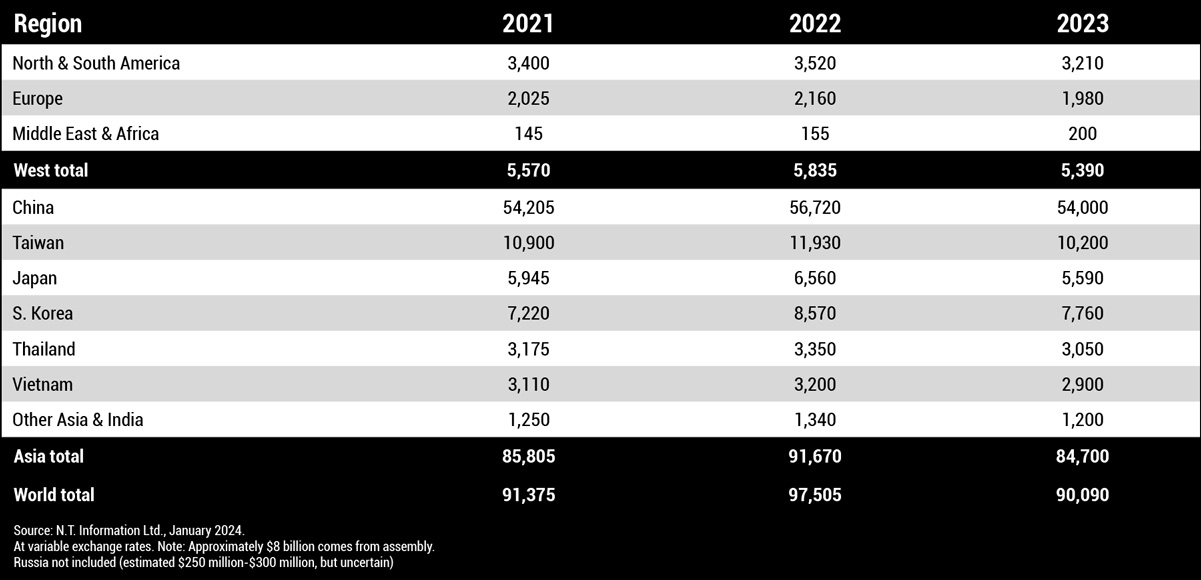

Compared to 2022, aggregate revenues of the “top” fabricators in 2023 decreased 8.5%. Listening to the voices of PCB fabricators, material and equipment fabricators, 2024 is “expected” to gain 7-8%, meaning the world output is expected to return to 2022 levels (Table 3).

Table 3. Preliminary Estimate of World PCB Output (US$ Million)

Of the 25 largest fabricators, DSBJ, Nippon Mektron, Kinwong, Wus, Meiko and Victory Giant are the only six that showed increased revenues in 2023. Several fabricators dropped from the 2022 list since their revenues were less than $100 million. A few Japanese fabricators dropped out because of the exchange rate.

Dr. Hayao Nakahara is president of N.T. Information and a contributing editor to PCD&F/CIRCUITS ASSEMBLY; This email address is being protected from spambots. You need JavaScript enabled to view it.. He is the world’s foremost authority on the worldwide printed circuit board market.