-

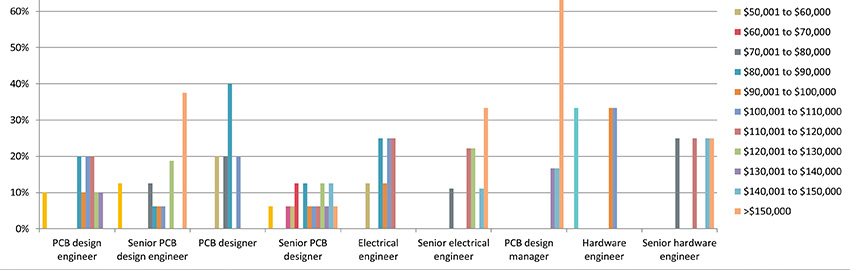

Show 'em The Money!

Designers salaries -- and workloads -- are on the rise. READ MORE...

-

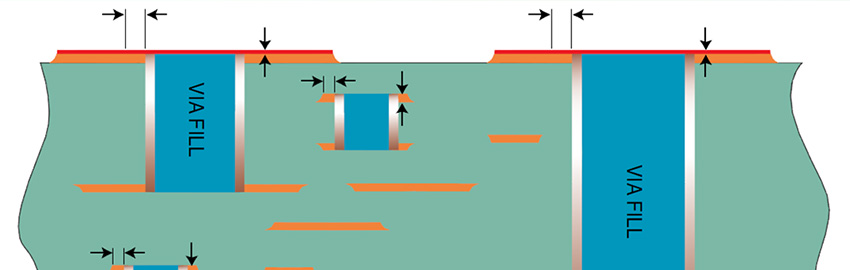

Novel Wrap Plating

Avoid via failures caused by post separation. READ MORE...

-

NTI-100: The World’s Top PCB Fabricators

The changing map of PCB production. READ MORE...

-

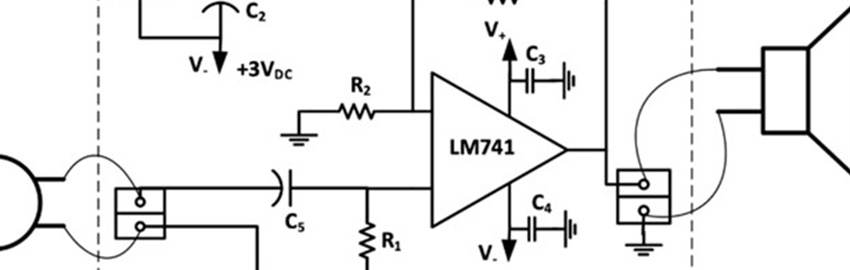

Optimizing Mixed Signal Circuit Designs

Navigating the analog and digital worlds. READ MORE...

Homepage Slideshow

Show 'em The Money!

Designers salaries -- and workloads -- are on the rise.

Novel Wrap Plating

Avoid via failures caused by post separation.

https://pcdandf.com/pcdesign/images/stories/slideshow/2510roy.jpg

NTI-100: The World’s Top PCB Fabricators

The changing map of PCB production.

Optimizing Mixed Signal Circuit Designs

Navigating the analog and digital worlds.