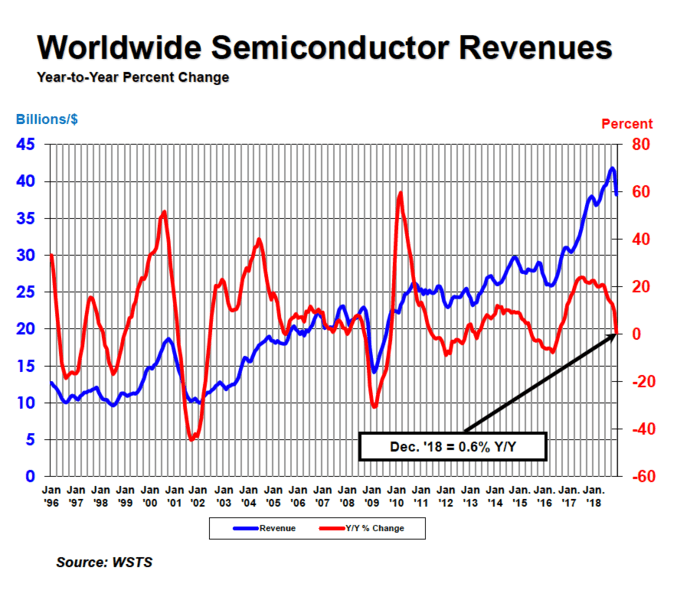

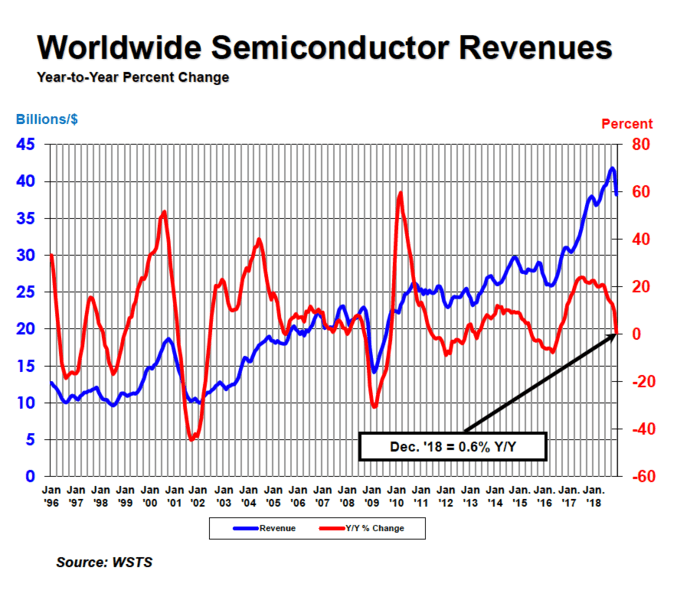

WASHINGTON – The global semiconductor industry posted sales of $468.8 billion in 2018, the industry’s highest-ever annual total, up 13.7% year-over-year.

Global sales for December reached $38.2 billion, an increase of 0.6% year-over-year and down 7% sequentially.

Fourth-quarter sales of $114.7 billion were 0.6% higher than the fourth quarter of 2017 and down 8.2% sequentially.

All monthly sales numbers are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average.

“Global demand for semiconductors reached a new high in 2018, with annual sales hitting a high watermark, and total units shipped topping 1 trillion for the first time,” said John Neuffer, SIA president and CEO. “Market growth slowed during the second half of 2018, but the long-term outlook remains strong. Semiconductors continue to make the world around us smarter and more connected, and a range of budding technologies – artificial intelligence, virtual reality, the Internet of Things, among many others – hold tremendous promise for future growth.”

In 2018, memory was the largest semiconductor category by sales, with $158 billion, and the fastest growing, with sales increasing 27.4%. Within the memory category, sales of DRAM products increased 36.4%, and sales of NAND flash products increased 14.8%. Logic ($109.3 billion) and micro-ICs ($67.2 billion) – a category that includes microprocessors – rounded out the top three product categories in terms of total sales. Other fast-growing product categories in 2018 included power transistors (14.4% growth/total sales of $14.4 billion) and analog products (10.8% growth/total sales of $58.8 billion). Even without sales of memory products, sales of all other products combined increased nearly 8% in 2018.

Annual sales increased across all regions: China (20.5%), the Americas (16.4%), Europe (12.1%), Japan (9.2%), and Asia Pacific/All Other (6.1%). For December, year-over-year sales increased in China (5.8%), Europe (2.8%), and Japan (2.3%), but fell in Asia Pacific/All Other (0.7%) and the Americas (6.2%). Sales for the month were down across all regions: Japan (2.2%), Asia Pacific/All Other (3.1%), Europe (4.9%), China (8.1%), and the Americas (12.4%).

“A strong semiconductor industry is critical to America’s economic strength, national security, and global technology leadership,” said Neuffer. “We urge Congress and the Trump Administration to enact polices in 2019 that promote continued growth and innovation, including robust investments for basic scientific research, long-overdue high-skilled immigration reforms, and initiatives that promote free and open trade, such as the US-Mexico-Canada Agreement (USMCA). We look forward to working with policymakers in the year ahead to further strengthen the semiconductor industry, the broader tech sector, and our economy.”