PORTLAND, OR -- Electro Scientific Industries reported fiscal fourth quarter revenue fell 3.1% from a year ago to $49.9 million.

Sales for the period ended Apr. 1 were up 48% from the December quarter, the maker of laser-based drilling systems added.

The net loss was $17.9 million, including $18.1 million of charges primarily related to restructuring and the impairment of goodwill, intangible assets, and inventory, of which $5.2 million are expected to be paid in cash. Non-GAAP net income was $2.9 million. The company reported a net profit of $1.9 million a year ago.

“The company had a strong quarter operationally with orders, revenues, and non-GAAP earnings exceeding expectations,” said Michael Burger, president and CEO of ESI. “The seasonally strong orders resulted in our highest backlog in nearly five years and position us well as we enter fiscal 2018. I am also pleased with the progress we are making on our restructuring plan. Our new executive team is in place and we are on track with our plans to improve our consistency of earnings over time."

Orders in the fourth quarter were $82.3 million, compared to $55.6 million last year and $44.1 million in the prior quarter. Burger continued, “Seasonally strong markets and solid execution drove orders to their highest quarterly level in over five years. Year over year we grew fourth quarter orders in all product groups, as well as in service."

On a GAAP basis gross margin was 36.5%, compared with 41.1% in the fourth quarter of fiscal 2016, and included approximately $4.0 million dollars of charges reflecting the impairment of intangible assets and impairment of inventory associated with our restructuring activities. Operating expenses were $36.3 million, up from $20.1 million one year ago, and included $6.6 million of restructuring costs and a $7.4 million impairment of goodwill. Operating loss was $18.1 million, compared to income of $1.1 million in the year-ago quarter.

On a non-GAAP basis gross margin was 45.7% compared to 42.7% one year ago. Non-GAAP operating expenses increased year over year to $20.1 million. Non-GAAP operating income was $2.7 million, or 5.4% of sales, compared to income of $3.3 million in the fourth quarter of last year.

Fiscal 2017 revenue was $161 million, down 12.7% compared to fiscal 2016. The GAAP net loss was $37.4 million, versus a net loss of $12.3 million in the prior year. On a non-GAAP basis, net loss was $9.4 million, compared to net loss of $1.7 million in 2016.

Based on current market and backlog conditions, revenues for the first quarter of fiscal 2018 are expected to be in the low $60 million range.

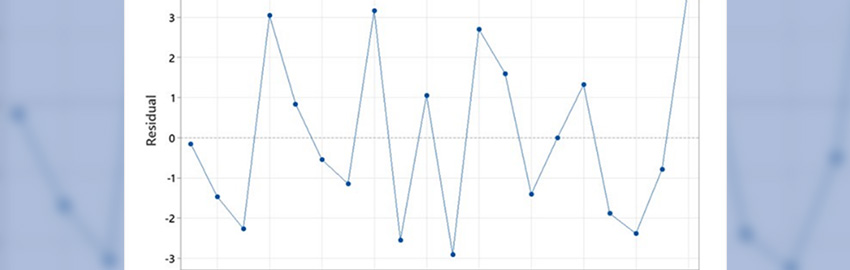

"Our markets were seasonally strong in the fourth quarter. Although visibility is limited, we are seeing a better market environment and fewer headwinds than one year ago, which is encouraging," Burger said. "Our objective is to execute and drive demand so that the seasonally weaker quarters will see less of a drop-off compared to last fiscal year. In addition, the reorganization we announced in February should help us to improve execution, lower our breakeven revenue level, and deliver profitability in both strong and weak demand cycles."