We asked a number of leading electronics experts for their vision of how the design and manufacturing landscape will change.

Robots, DNA-based circuits, 3D printers, supply chain migration: These are just some of the challenges – and opportunities – the electronics industry is facing today. What’s feasible, and what’s not?

In search of what the industry thinks might happen, we asked several leading engineers and executives over the past month to share their vision. In some instances we put a deadline on the transition; in others, the question was open-ended.

We spoke with designers, fabricators, assemblers, and suppliers. Those interviewed ranged from primarily regional players to some of the biggest companies in the industry today. Input came from veterans of startups and blue chip OEMs, some who spent a lifetime in electronics, and some who only recently joined the industry. What was stressed to our esteemed panel was not so much a specific response (i.e., yes or no) but rather the reasoning behind their answers. We hope you enjoy their thoughts.

1. Will robots run SMT lines?

Phil Marcoux, founder PPM Associates; known as the “Father of SMT”: Not for the vast majority of SMT lines. The cost of programming robots, as well as some of the normal SMT equipment, often exceeds the cost of manual control, especially when the builds are low to medium volume and for products that experience numerous revisions. The lines that justify a higher level of automated/robotic control are those where human error and human presence would cause potential yield loss and reliability issues. Examples of such products would be medical products and others requiring the most stringent of ESD and clean room control.

Markus Wilkens, president, ASYS Group Americas: Absolutely yes. Pick-and-place is already doing all but hand assembly. Now there’s solder robots. Automotive plants have artificial intelligence. Do you trust an operator to make the decisions? The next step is, do you allow a lower qualified employee to make the decision on what needs to go next?

Cameron Shearon, lead quality engineer SCM, AT&T: Because most errors are caused by humans, and robotic technology is quickly evolving, becoming more flexible and getting less expensive, I think it is inevitable that robots will become much more pervasive in running SMT lines. Wafer fabs, automotive, and some assembly lines already have a high utilization of automation. However, I don’t think robots will be running SMT lines in the next 10 years or so.

Michael Ford, marketing development manager, Mentor Graphics and former GM, Sony Europe: The challenge is putting the material on the machine. So it’s looking at a new way to put materials on them. Standardization to link automated guided vehicles. Will it actually happen? I don’t know, but it’s not impossible.

The alternative is to make feeders more intelligent where they pick the materials and talk directly to the planning system. That’s possible. If you think feeders and reels can be replaced with an alternative system … you could do that now.

If you had a mechanical changeover, you could go from a sequential to a parallel approach. That could be very interesting. Machines could change over on the fly, intelligently.

Attack of the robots. Could machines such as Rethink Robotics’ Baxter replace humans en masse on SMT lines? (Courtesy Jabil)

2. Will solder be eliminated?

Mick Austin, sales director, Vitronics Soltec: For some applications, like low power or wearables, I think it could. What’s more likely is a whole new wave of products might come along that are solderless from the start.

Karl Seelig, vice president, technology, AIM Solder; inventor: Eventually. I’ve been in the business since 1976. When I came in, silver epoxy was the future. Today it has less than 10% of the market because of inherent problems. Until components are embedded in boards, I doubt in my lifetime. I could see direct bonding to circuitry.

3. What’s more likely: completely custom boards or 100% reference designs?

Carl Schattke, PCB design engineer, Tesla Motors: I think we will still see both board types in 2020, but would lean toward a far greater use of custom board solutions. We could also see a scenario where the Arduino model (Lego style circuits) incorporates a far greater catalog of system sub-components for various conceptual embedded systems projects. Increased cooperation is the wave of the future, and the companies that learn to do this will speed up development and leapfrog many of the leading companies today.

Gary Ferrari, director – technical support, FTG Circuits; former executive director, IPC Designers Council: Reference designs are just what they are called: reference and/or recommendations. They tend to be placed on boards along with customized, application-specific support circuitry/designs. So, my answer would be custom boards that include the use of one or more reference designs.

Rob Rowland, engineering manager, Axiom: It depends on the market segment. My company builds primarily military [electronics], and it’s all custom. Military and medical are still custom.

4. By 2020, will optoelectronics be mainstream?

Gary Ferrari: Optoelectronics has been a long time coming. Drawbacks include technical fabrication difficulties that limit its general use. Current high-speed technology is just about tapped out. I believe that a major push to overcome current optoelectronics fabrication difficulties from entering the mainstream is on the horizon. By 2020, we should see more use in mainstream high-tech electronics. Optoelectronics in low-end electronics may be cost-prohibitive, and may never make it, at least not by 2020. As an example, embedded active devices have been around in Japan for the past five years or so, yet haven’t taken off in North America. It will probably take another five years to migrate. Optoelectronics has been around even longer and not really taken hold.

Jim Hall, SMT process consultant and former machine designer: I would say so. The advantages of speed and processing, and the technology is maturing enough with 3D structures being more acceptable.

Jack Fisher, facilitator, HDP User Group: Optoelectronics will appear on some products by 2020, but only in selected markets. Telecom backplanes, definitely. High-end servers, possibly. The waveguides may or may not be embedded. On a backplane with lots of room, waveguides on flex are a very real possibility. Communication between the backplane and switch cards can be flex or optical cable.

5. Will hobbyists overwhelm the traditional design/fabrication/assembly/distribution model?

Rob Rowland: Probably not, but they will have more and more of an impact. The president of our company falls into that category: He always brings in products he’s created with COTS stuff. We will see more of that. Of course, what will we do if Radio Shack doesn’t survive?

Duane Benson, marketing manager, Screaming Circuits: I don’t see that hobbyists and DYIers will overwhelm or replace the traditional model. What I see is many more options added into the mix, and barriers to entry dropping for low-volume, high-margin businesses. It will, for the foreseeable future, be considerably less expensive to mass produce products using traditional means than it will be using personal manufacturing. However, an almost unimaginable number of low-demand or customized products will be possible. The consumer goods business will be split wide open in markets where the buyers have enough money to buy things that may seem pretty silly today, such as custom electronic coffee mugs.

Terry Heilman, president and CEO, Sunstone Circuits: No. While the hobbyist market is growing, so are the DIY tools and community collectives to support these markets to make what they need without the classic distribution sources. That phenomenon should keep a large enough percentage of them out of the traditional manufacturing distribution model.

6. Will ODMs supplant OEMs?

Phil Marcoux: No. ODM partnerships are attractive for companies (usually large OEMs), where they can outsource the more routine product designs to a company, which will perform the design as well as the build to print services for less than what the customer would pay if designed and manufactured internally. However, the forces of rapid time-to-market and control of company IP dictate that any company that wants to continue to provide leading-edge and innovative products continues to control and administer much of its research, development, and design activities.

Charlie Barnhart, analyst, founder Charlie Barnhart & Associates: Not completely, but very likely at both the bottom and top of the tech curve.

Brian D’Amico, president Mirtec USA: Maybe 20%. There are so many types of products that are made. I would think maybe on some level, but it would be very specialized.

Susan Mucha, president, Powell-Mucha Consulting: ODMs tend to drive technology in specific sectors, most often where technology is considered a commodity, and the “user experience” or capabilities of the supporting infrastructure are considered the market differentiator. Often the technology “advances” are closely tied to requirements driven by the OEM-defined user experience strategy or related to the service selling strategy infrastructure “owners” want to exploit. I think in areas where technology continues to be the market differentiator, OEMs will be the developers of new technology.

7. Is the number of manufacturers worldwide more likely to halve or double by 2020?

Gene Weiner, consultant and board member, WKK: The number of manufacturers is more likely to double by 2020. The reason is that even though there is consolidation in maturing industries, there are many new opportunities arising from the needs of newly emerging technologies, such as wearable electronics, the expansion of touch and near touch sensors and controls for communications and automotive electronics, printed electronics, the expansion of automotive applications and controls, IoT, IoM, the privatization of space activities, advances in 3D printing, and more visions of future products not yet even in sight. Most innovations usually come initially from smaller ventures or startups.

Randall Sherman, analyst and president, New Venture Research: The number of manufacturers (EMS, I presume) is likely to halve. This is already happening. [My research shows the] trend is definitely toward consolidation. The weak are fading away or getting acquired, and the strong are securing or further establishing their markets. Acquisitions are either purchasing supplier capability or customers. There is no way the population will double or even grow.

Susan Mucha: I think the number will shrink. I could see segments such as Tier One EMS shrinking broadly through consolidation driven by competition, but I don’t think that pattern will happen as dramatically in the lower tiers. If anything, I’m seeing a growth in sales in the lower tiers as OEMs show a preference for regionalization (putting the manufacturer closer to product development or a specific facility).

Duane Benson: Both will happen. Traditional manufacturers will be hit with consolidation and attrition losses. However, a new class of manufacturing is already in an emergent phase. These manufacturers, like Screaming Circuits, have a transactional relationship with customers, more like selling an e-commerce product than like a traditional manufacturing partnership. Further, this transactional model, when combined with easier-to-use, more self-contained machinery, will allow very small manufacturing businesses to be profitable. Boutique manufacturing will be viable and common.

Todd Scheerer, executive vice president, Zestron: I’d lean toward double. Electronics are becoming more a part of what everyone does every day. The number of applications in, say, automotive, is so much more now than 10 years ago.

8. Will plated through-holes be eliminated?

Terry Heilman: They will not be eliminated in the next five years. They may be down fairly significantly for new designs, but, like leaded solder, it is a tried-and-true technology that will be difficult to eliminate from the vernacular of the design engineer. Yes, there could be new technologies in the future, but nothing replacing plated through-holes anytime soon.

Andy Cameron, field application engineering manager, TTM Technologies: Fully additive (3D printing) PCB manufacturing allows for eliminating through-hole interconnects if desired (all surface mount, no press-fits, for example), but it goes well beyond that in terms of completely altering what is possible compared to subtractive manufacturing used today.

Jack Fisher: I don’t think PTHs will be eliminated. There does seem to be a need for fewer PTHs, but they are not going away.

Jim Hall: No. We have to have places to solder connectors. We have to have the mechanical interface where high stresses occur. Plus the momentum of highly embedded processes; you’ll find some way to use it somehow. Many economic models depend on it.

Carl Schattke: I do not think PTHs will be eliminated. What could replace them? Conductive adhesives? 3D printed wiring?

9. Will 3D printing be mainstream by 2020?

Raj Kumar, vice president technology & engineering, Specialty Products Business Unit, TTM Technologies: Unlikely. The current and very limited 3D printing technology for PCBs is not to the caliber necessary with regard to interconnects, line/space, multilayer capability, long-term reliability, survivability through multiple lead-free assembly reflow cycles, high-speed signal transmission, power carrying capability, etc., but it is evolving rapidly, particularly with the material science portion.

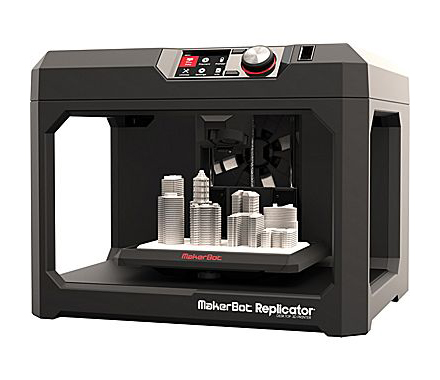

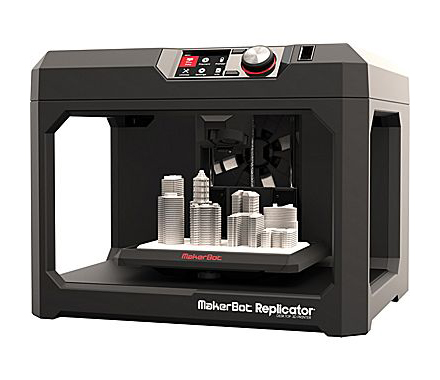

Is 3D printing the future? Prices are coming down and capability is rising on printers like this one from Makerbot.

10. Will we more likely be disrupted by a company in our industry, or outside it?

Brian D’Amico: Inside. Most of the products we make are for companies that use them, so that would have the most drastic change for someone like us. Changes in equipment will be disrupted by new electronic end-products.

Michael Ford: I’d like it to be a new plan because there’s lots of resistance to change. Someone who comes in and addresses the market the way the market needs – e.g., direct shipping from a flexible factory to a customer. Then they could do it like the old days, build close to where it’s used.

Cameron Shearon: Given that someone can have an idea but not have the financial resources to set up a manufacturing line, it is equally likely that disruptions can occur from in our industry or outside it. Another example over the longer term is 3D printing – the price is coming down, the precision is increasing, and more materials are being utilized. Some organizations are even trying to develop 3D printers to make ICs. Instead of shipping to a particular market, they could build just for that market by simply printing it out. In addition, through the First Self-Replicating Synthetic Bacterial Cell project, the J. Craig Venter Institute developed a way to digitize and print DNA. Uses of this technology are to print vaccines in locations where they are needed rather than shipping them over long distances, while trying to maintain tight climate controls. If life were found in one location, it could be mapped and transmitted to another location to be studied.

This is the first I have seen a blending of electronics and the biological/drug industry. It will be interesting to see if or how that continues to play out.

Gene Weiner: No one innovation from outside the industry will disrupt the entire industry. An “outsider” such as Tesla will accelerate changes to the use of standby battery power and electric cars but not “disrupt” an industry segment. I do not believe a company totally outside our industry will disrupt the electronics industry.

Todd Scheerer: It’s common in a lot of industries to get blinders on. Everyone is doing incremental innovation. It’s hard to step out and do game-changing innovation. It’s more likely someone will take something that worked in another industry and apply it [to electronics]. Most industries tend to be disrupted from the outside.

Markus Wilkens: Definitely outside. Inside, you have blinders. You can get so focused on what you do, even in R&D. Why are we still etching boards? We should be printing boards. It’s mind-boggling what these companies [outside electronics] are doing with printing ferrous materials. The really new always comes from the outside.

All in the software? Will remote firmware upgrades mean IoT devices improve on the fly?

Mike Buetow is editor in chief of PCD&F/Circuits Assembly; This email address is being protected from spambots. You need JavaScript enabled to view it..