COLD SPRING HARBOR, NEW YORK – The overall PCB materials market dropped significantly in 2023, including rigid laminates, with uneven declines across different segments, Prismark found in its most recent market report.

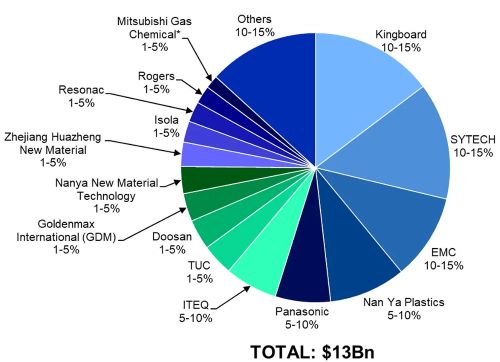

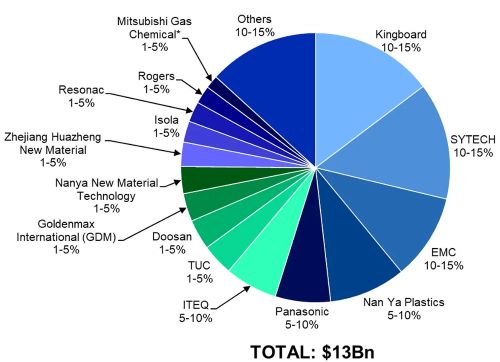

In 2023, the $57 billion PCB industry (excluding flex) included a total copper clad laminate (CCL) market of around $13 billion, including prepreg but excluding mass laminate – a decrease of 16% from 2022. In area terms, the market represented 650 million sq. m. of rigid laminate materials, including paper, composite, FR-4, and specialty laminates/other – a slight decrease from 2022.

The report found that the conventional rigid CCL segment experienced strong price erosion due to weak demand, especially from the PC, infrastructure, consumer electronics, and smartphone markets. Package substrate laminates suffered from oversupply issues and price declines. RF laminate demand from the automotive ADAS and military/aerospace markets was relatively stable in 2023, but growth was offset by the sharp ASP decline in RF materials, especially for wireless infrastructure applications.

The only segment that achieved positive growth and outperformed the overall market in 2023 was high-speed CCL, which benefitted from AI server and high-performance computing (HPC) applications.

The top ten laminate suppliers in 2023 represented 75% of the market in terms of sales. The ranking of the top four laminate manufacturers has changed compared to the previous year – Kingboard, Shengyi Technology (SYTECH), EMC, and Nan Ya Plastics – and represent about 48% about half of the overall market (excluding mass laminate).

2023 saw notable declines in the profitability of laminate suppliers. One of the key reasons behind this decline was the drop in ASP across all segments, especially conventional. Laminate prices began to decline at the beginning of 2022, unlike copper foil and prepreg prices that stabilized and slightly rebounded in Q4 2022, and then became relatively stable in 2023. The price of CCL did not rise with upstream material prices due to weak downstream demand and market competition, further exacerbating the decline in revenue and profitability.

In addition to declining ASP, many leading rigid CCL suppliers experienced a drop in demand in 2023, especially in the first half. This trend was particularly evident among suppliers whose end customers were in the industries related to personal computing, smartphone, and consumer electronics. Weakened demand had a further negative impact on the suppliers’ financial performance, as they struggled to maintain market share in a highly competitive environment.

As of today, while inventory levels are on a positive trajectory, there is still work to be done to balance supply and demand. With weak end-demand and high inventory levels among downstream customers, materials manufacturers face challenges in both production value and volume.