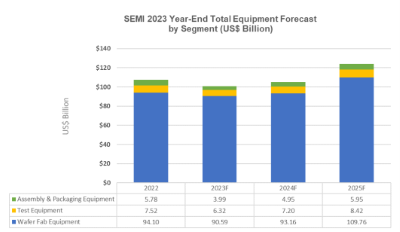

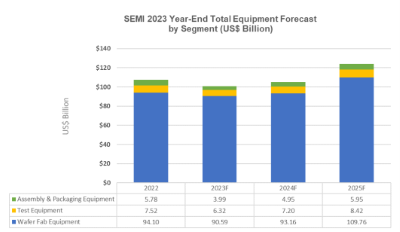

TOKYO – Global sales of total semiconductor manufacturing equipment by original equipment manufacturers are forecast to reach $100 billion in 2023, a contraction of 6.1% from the industry record of $107.4 billion posted in 2022, SEMI announced in its Year-End Total Semiconductor Equipment Forecast – OEM Perspective at SEMICON Japan 2023.

Semiconductor manufacturing equipment growth is expected to resume in 2024, with sales forecast to reach a new high of $124 billion in 2025, supported by both the front-end and back-end segments.

"We anticipate a temporary contraction in 2023 due to the cyclical nature of the semiconductor market," said Ajit Manocha, SEMI President and CEO. "2024 will be a transition year. We then expect a strong rebound in 2025, driven by capacity expansion, new fab projects, and high demand for advanced technologies and solutions across the front-end and back-end segments."

Semiconductor Equipment Sales by Segment

After registering a record $94 billion in sales last year, the wafer fab equipment segment, which includes wafer processing, fab facilities and mask/reticle equipment, is projected to slip 3.7% to $90.6 billion in 2023. This contraction marks a significant improvement from the 18.8% decline forecast by SEMI in its Mid-Year Total Semiconductor Equipment Forecast – OEM Perspective.

The upward revision is primarily due to strong equipment spending by China. Wafer fab equipment segment sales are projected to grow at a modest 3% in 2024 from the revised 2023 base due to limited memory capacity addition and the pause of mature capacity expansion. A growth path with a further 18% expansion in 2025 is expected as new fab projects, capacity expansion and technology migrations drive investments to nearly $110 billion.

The decline in back-end equipment segment sales started in 2022 and continued in 2023 due to challenging macroeconomic conditions and softening semiconductor demand. Semiconductor test equipment market sales are projected to contract by 15.9% to $6.3 billion in 2023, while assembly and packaging equipment sales are expected to drop by 31% to $4.0 billion in the same year. The test equipment and assembly and packaging equipment segments are forecast to expand by 13.9% and 24.3%, respectively, next year. Back-end segment growth is expected to continue in 2025, with test equipment sales rising 17% and assembly and packaging sales increasing 20%.

Semiconductor Equipment Sales by Application

Equipment sales for foundry and logic applications, accounting for more than half of total wafer fab equipment receipts, are expected to log a 6% increase year-over-year to $56.3 billion in 2023 despite softer end-market conditions. The application segment is forecast to contract 2% in 2024 as mature technology expansion slows and spending on leading-edge technology improves. Foundry and logic equipment investments are projected to increase 15% in 2025 to $63.3 billion, driven by increased capacity expansion purchases and the introduction of new device architectures.

As anticipated, memory-related capital expenditures will see the sharpest decline in 2023. NAND equipment sales are predicted to drop by 49% to $8.8 billion in 2023 but will surge 21% to $10.7 billion in 2024 and rise another 51% to $16.2 billion in 2025. DRAM equipment sales are expected to remain stable, growing by 1% and 3% in 2023 and 2024, respectively. Supported by continuous technology migration and expanding demand for high-bandwidth memory (HBM), DRAM equipment segment sales are expected to increase an additional 20% to $15.5 billion in 2025.

Semiconductor Equipment Sales by Region

China, Taiwan and Korea are expected to remain the top three destinations for equipment spending through 2025. China is projected to maintain the top position over the forecast period as the region’s equipment billings continue to soar. Equipment shipments to China are projected to surpass a record $30 billion in 2023, widening its lead with other regions. While equipment spending for most tracked regions is expected to fall in 2023 before resuming growth in 2024, China is expected to see a mild contraction in 2024 after heavy investments in 2023.

The following results reflect market size by segment and application in billions of US dollars: