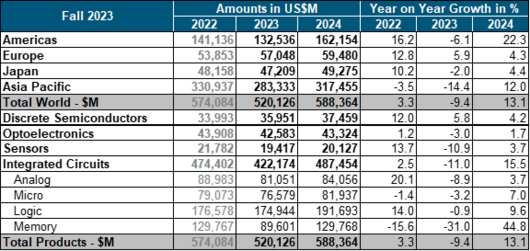

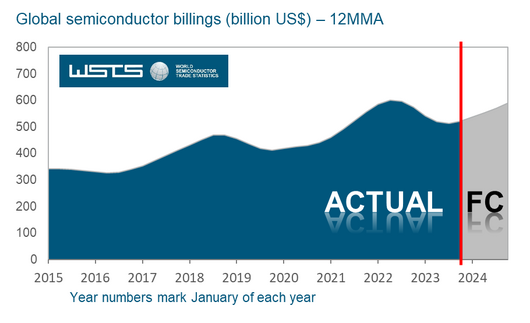

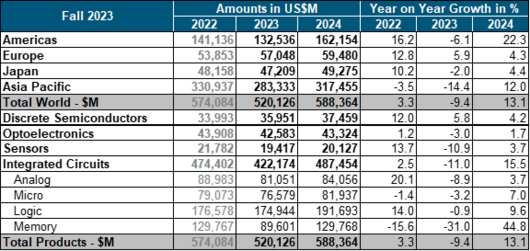

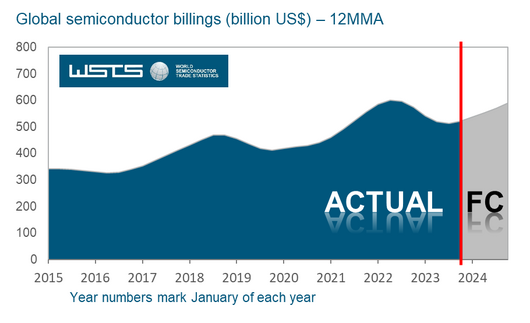

MORGAN HILL, CA – The World Semiconductor Trade Statistics organization has revised its 2023 forecast for the global semiconductor market, anticipating a single-digit contraction of 9.4% for the year, followed by a robust recovery in 2024 with an estimated growth of 13.1%.

The updated market valuation for 2023 is now estimated at $520 billion, marking a 9.4% decline from previous year.

Reflecting the stronger performance observed in the last two quarters, WSTS has revised its growth projections slightly upward, noting improvements in certain end-markets. For 2023, Discrete Semiconductors, primarily propelled by Power Semiconductors, are projected to experience a 5.8% year-over-year growth. However, all Integrated Circuit categories, including Analog, Micro, Logic, and Memory, are anticipated to witness an 8.9% decline compared to the previous year. This downturn, though significant, is less pronounced than initially forecasted in May 2023.

For 2023, only the European market is projected to experience growth, with an increase of 5.9%. Conversely, the remaining regions are anticipated to face a downturn, with the Americas expected to decline by 6.1%, the Asia Pacific region by 14.4% and Japan by 2%.

Anticipated Revival in the Global Semiconductor Market for 2024

The outlook for 2024 points to a vigorous upswing in the worldwide semiconductor market, with projections indicating a 13.1% increase, reaching a valuation of $588 billion. This growth is expected to be largely fueled by the Memory sector, which is on track to soar to around $130 billion in 2024, representing an upward trend of over 40% from the previous year. The majority of other principal segments, including Discrete, Sensors, Analog, Logic, and Micro, are also expected to record single-digit growth rates.

From a regional standpoint, all markets are poised for ongoing expansion in 2024. The Americas and Asia Pacific, in particular, are forecasted to demonstrate significant double-digit growth on a year-over-year basis.