TAOYUAN, TAIWAN – The global flexible PCB (FPC) market is expected to total $17.2 billion in 2023, a 12.6% drop from 2022's market worth of $19.7 billion, according to the Taiwan Printed Circuit Board Association (TPCA) and Science and Technology International Strategy Center (ISTI) of the Industrial Technology Research Institute (ITRI).

High inventory levels and a decrease in consumer demand are the primary drivers behind the decrease, but the global FPC market is expected to return to a 5.4% growth in 2024 as end-user inventory adjustments settle down. Key markets such as smart phones and computers are expected to recover as the demand for automotive FPCs continue to grow.

Taiwanese companies remained the largest supplier of FPC at 41.1% of the overall market, followed by Japanese and Chinese companies. Vendors from these three nations accounted for 90% of the global FPC market. In terms of applications, communication products remain the largest market for FPC at 56.2%, followed by computer applications (19.8%) and automotive applications (13.6%).

Despite the pressures in demand, most vendors continued to invest heavily in the three key trends of high-frequency and high-speed, multi-layering and thinning and automotive FPC (especially battery FPC) to boost production capacity and upgrade their technology in preparation for future changes in market demand.

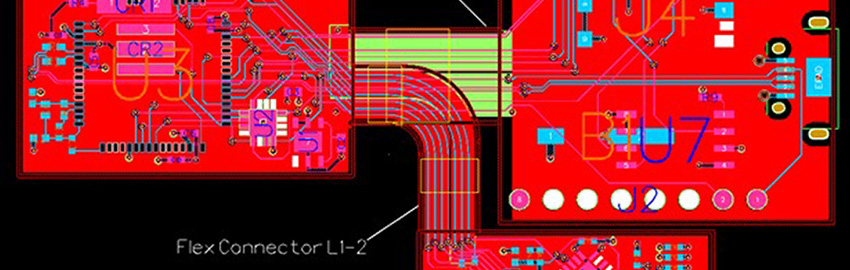

High-frequency/high-speed applications are due to existing Modified Polyimide (MPI) technology no longer been adequate now that smart phones are moving into the millimetric band. Once the transmission frequency is increased to 28/39 GHz or higher, high-frequency materials such as Liquid Crystal Polymer (LCP) or fluorinated products must be used instead; highly integrated product functions also require thinner circuit designs for FPC connecting the camera module and the mainboard. Line width/line spacings of 30/30µm based on mSAP technology are already in mass production and will progress to even thinner 25/25µm layouts in the future.

FPC is also gradually converging with HDI technology with multi-layer and stacked via designs becoming more prevalent. These are not only being used in smart phone applications but will also be extended to AR/VR and autotronics. Increased layer counts and the need for filling of blind vias mean these technologies will become a challenge for using FPC in curved applications.

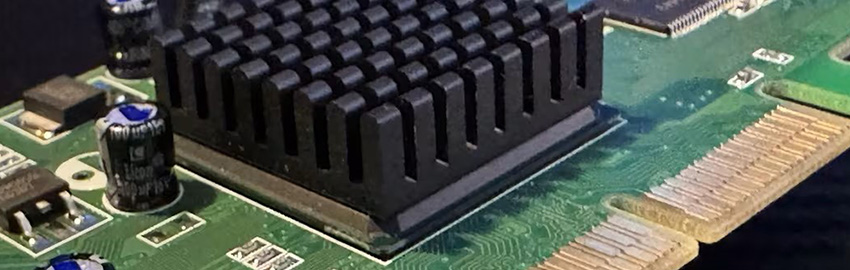

In conventional internal combustion vehicles, the main applications for FPC were power, lighting, sensors and onboard infotainment systems. The growing popularity of electric vehicles in recent years means battery management systems (BMS) have joined the line-up of electronic components. BMS demand for battery FPC is growing at a rapid pace as it is 70% lighter than wiring harnesses rated for the same current load and has a far smaller footprint. Battery FPC is longer compared to FPC for consumer electronics and may measure up to 1,500-1,800mm in length, so precision control is critical to yield rate for large form-factor production processes.

With the supply chain is moving to a “China+1” strategy to balance geopolitical risks, Southeast Asia has become a hot spot for business investments – and the same applies to the FPC industry as well. The most proactive of these have been Japanese companies with most investments concentrated in Thailand and Vietnam. They have also continued to expand their production capacity for smart phone and autotronic product applications in recent years; BHflex from Korea has established a production site in Vietnam but has no expansion plans as yet; FPC manufacturers in China have not yet established a presence in Southeast Asia; among Taiwanese companies, CMI announced plans to build a factory in Thailand while ZDT, the leading FPC maker, is planning to set up shop in Thailand (although production will mostly be focused on rigid PCB for automotive and server applications). FPC substrate supplier Taiflex has also set its sights on Southeast Asia’s onboard market, and announced last year that it was investing in Thailand with mass production slated to begin by the end of 2024.