TAOYUAN CITY, TAIWAN – Taiwanese PCB output totaled NT181.8 billion ($5.88 billion) in the first quarter, a year-on-year decline of 15.4%, according to the Taiwanese Printed Circuit Association.

Last year saw a relatively strong base period due to the pandemic and semiconductor bonuses (up to 20.8% YoY), while this year, a multitude of factors, including a correction in the global economy, high inventory levels, and weak end-user demand, all contributed to the downward trend in business revenues, TPCA said.

In terms of PCB applications in the first quarter, consumer electronics saw a shrunk in demand from non-essential spending on appliances, wearable devices, and audio-visual entertainment products. A drop in iPhone sales, in particular, weighed on the revenues of associated vendors. However, network communication products bucked the trend due to strong demand from telecommunications infrastructure and satellite communications. The lifting of global pandemic lockdowns led to a steep decline in PC and notebook sales, and aggressive cost-cutting by businesses also impacted server spending. Automotive sales were a highlight of this quarter. Electric vehicles (EV) and autotronics are expected to drive the steady growth of related PCB sectors.

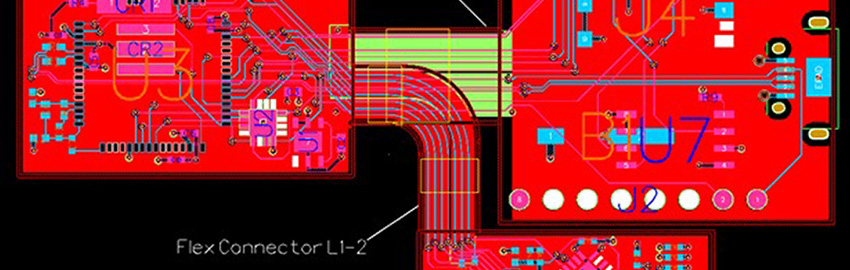

Analysis of Taiwanese PCB product structure found that even IC carriers were not immune to the downturn in demand despite 12 consecutive quarters of growth. The first quarter saw a 13.2% YoY decline and the second quarter is looking less than promising based on the overall outlook of the semiconductor industry. In Flex PCB, even though the automotive sector put on a strong performance in the quarter, weak demand in key applications such as smartphones and notebooks meant that the decline in Flex PCB increased from 8.5% in the fourth quarter of last year to 13.4% in the first quarter. Even though the second quarter has traditionally been the off-season for Flex PCB, a mild recovery in computer-related applications may compensate for the slump in smartphones.

Growth in Multilayer PCB began showing signs of slowing in the third quarter of last year, making it one of the earliest PCB products to be affected by the economic downturn. The decline had exceeded two digits (13.5% and 14.0%) for two consecutive quarters, so overall demand is still bottomed out. On the other hand, a recovery in demand from automotive and network communications and restocking inventories by notebook channels may all boost the business performance of Multilayer PCB vendors. A reduction in the magnitude of decline may therefore be seen in the second quarter. HDI is widely used in all types of applications. Despite a relatively strong performance in automotive applications in this sector, this was insufficient to overcome the two-digit decline in consumer electronics such as smartphones, notebooks and wearable devices. HDI, therefore, saw its decline in output increase to 16.4%.

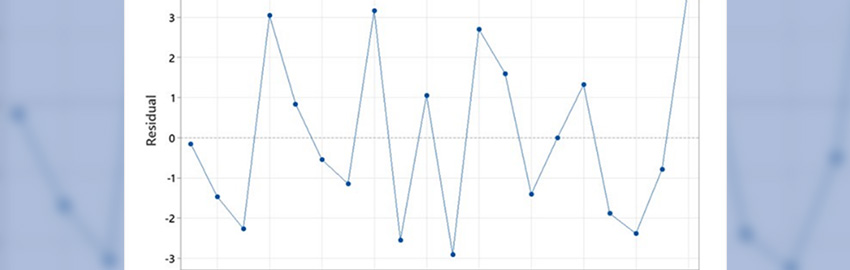

The overall economy has a high level of uncertainty, TPCA said, due to factors such as high inflation and high interest rate. Supply chains are therefore continuing to be conservative in their stocking strategy, with most turning to rush and short orders. Order visibility remains uncertain and the impact can already be seen in this quarter. In terms of future development, a recovery in end-user demand and speed of destocking is critical to industry output. Growth is expected in automotive and network communication products, but consumer products may remain weak if no innovative applications should emerge. In terms of destocking, restocking end-user inventories on computer products is having an impact. However, destocking smartphones will still take time, and this should help re-ignite demand for PCB-related products such as smartphones. IC carriers are closely linked to semiconductors, so weak consumer demand will impact their destocking time. Taiwanese PCB makers are therefore expected to see a decline of 13.4% in global output in the second quarter. The total output in NTD for 2023 is expected to decline by 6.2% (or 8.2% if using USD). A recovery in consumer demand in the second half of the year may help the PCB industry return to the offensive again.