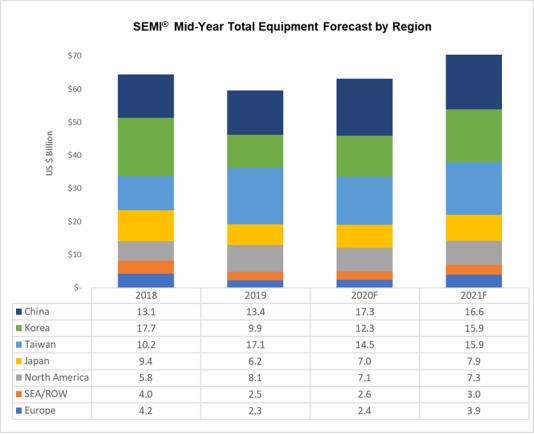

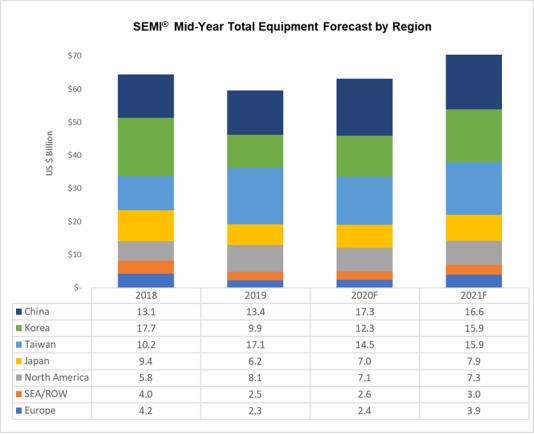

MILPITAS, CA – Global semiconductor manufacturing equipment sales by OEMs are projected to increase 6% year-over-year to $63.2 billion in 2020 before logging record high revenue of $70 billion in 2021 on the strength of double-digit growth, SEMI said.

The wafer fab equipment segment, including wafer processing, fab facilities, and mask/reticle equipment, is expected to rise 5% this year and 13% in 2021, driven by a memory spending recovery and investments in leading-edge and China.

Foundry and logic spending, accounting for about half of total wafer fab equipment sales, will see single-digit increases in 2020 and 2021. Both DRAM and NAND spending in 2020 will surpass 2019 levels and are projected to grow more than 20%, respectively, in 2021.

The assembly and packaging equipment segment is forecast to grow 10% to $3.2 billion in 2020 and 8% to $3.4 billion in 2021, driven by advanced packaging capacity buildup. The semiconductor test equipment market is expected to increase 13%, reaching $5.7 billion in 2020, and continue the growth momentum in 2021 on the back of 5G demand.

Regionally, China, Taiwan and Korea are expected to lead the pack in spending in 2020. Robust spending in China in the foundry and memory sectors is expected to vault the region to the top in total semiconductor equipment spending in 2020 and 2021. Taiwan equipment spending, after seeing 68% growth in 2019, is forecast to contract this year but bounce back with 10% growth in 2021, with the region maintaining the second spot in equipment investments. Korea is expected to rank third in semiconductor equipment investments in 2020 by outstripping its 2019 levels, making it the third top spender in 2020. Korea equipment spending is projected to grow 30% in 2021, powered by the memory investment recovery. Most other regions tracked will also see growth in 2020 or 2021.

Register now for PCB West Virtual 2020, the leading conference and exhibition for the printed circuit board industry, coming this September. pcbwest.com