TAOYUAN CITY, TAIWAN – Taiwanese PCB manufacturers had 2019 revenues of NT$662.4 billion (US$21.4 billion), up 1.7% compared to 2018, according to the Taiwan Printed Circuit Association.

First quarter revenues are expected to be NT$131.2 billion, with order deliveries deferred to the third and fourth quarters.

TPCA estimates Taiwan's PCB fabricators will generate revenues of NT$681.1 billion (US$22.6 billion) in 2020, up 2.8%, provided the coronavirus outbreak eases in the first half of the year.

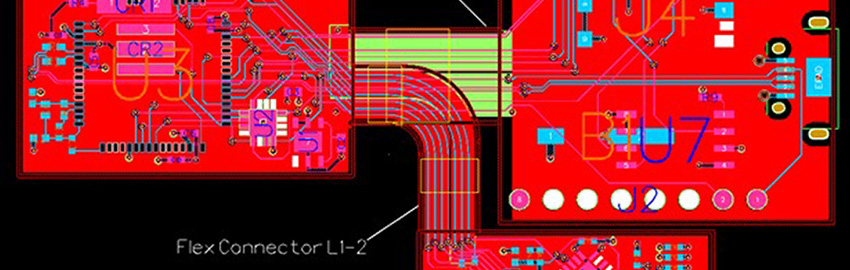

Growth in 2019 was bolstered by the amelioration of the cloud computing market in the third and fourth quarters, said TPCA. Aside from smartphone PCBs, which were down 0.9%, Bluetooth headsets and phone lenses have boosted rigid-flex PCB growth by 40%. The revival of the semiconductor industry and continuous development of advanced computing applications (e.g., 5G station deployment, AI and GPUs) escalated demand for IC substrates and ABF boards. IC substrate revenues grew 4.1% in 2019.

About 63.4% of the output by Taiwanese-owned fab shops came from China. Compared to competitors in Japan and South Korea, which have distributed production to South Asian countries, overseas distribution of Taiwanese PCB manufacturers is low, said TPCA.

Most Taiwanese PCB manufacturers have been permitted to resume production following the Covid-19 outbreak. Normal production remained unaffected, according to TPCA, despite the material supply shortage. However, Taiwanese PCB manufacturers may face near-term capacity limitations. Second quarter orders will depend on epidemic conditions and the acceleration of customer verification.

Based on the current situation, most organizations believe the epidemic will completely end in the second quarter, with impacts concentrated in the first quarter only, according to TPCA.

As a result of Covid-19, demand from 5G and various terminal electronics will be delayed. The US-China trade war in 2019 has made electronics assembly and PCB manufacturers reconsider their deployment, while the Covid-19 epidemic has impelled them to make strategic adjustments of risk dispersal.

In the short run, manufacturers will review the flexibility of their existing capacity deployment and materials supply sources. In the long run, they will accelerate industrial upgrading and capacity distribution to avoid putting all their eggs in one basket and strengthen the constitution of smart manufacturing to prevent the tempo of business growth from being upset by unpredictable macro-environmental changes.

Ed.: NT$1 = US$0.03