Are we about to return to an era of rapid inflation escalations?

Are we about to return to an era of rapid inflation escalations?

When you have been around the block as many times as me, events eerily remind you of similar events from a different time. Or, as legendary baseball player Yogi Berra supposedly said, “It’s like déjà vu all over again!”

I began my career in the mid-1970s. Those were very different times. Technology was primitive compared to what we take for granted today. “Social media” was confined to writing a letter (on paper!) or picking up a phone (tethered to the wall!). Another distinction was something called inflation. For the span from the early ’70s through the mid-’80s, the annual inflation rate ranged between 12% and 20%.

Working for a large, global, electronic connector company at that time, one of the jobs I held was that of division “pricing administrator.” When promoted to the position, I remember feeling heady about so much responsibility. I soon realized I was going to be a very busy guy.

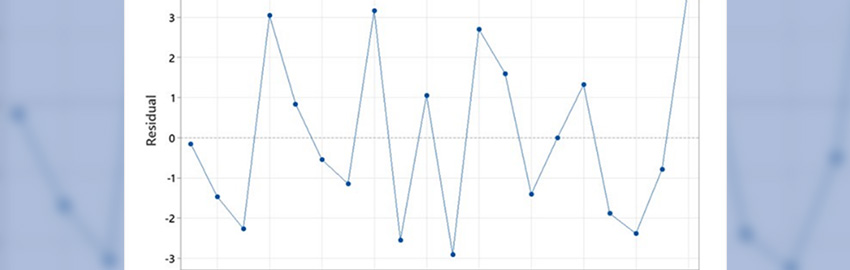

Besides the everyday tasks of quoting large quantity orders and “special configurations” of our products, I was responsible for periodic updates to our price book, which contained something like 10,000+ part numbers, with three to six price columns each. Historically, prices were adjusted roughly every 12 to 18 months. With annual inflation in the double digits, however, management wanted to update the price book more often. Way more often. In my three years in that role, we revised prices four times each year. Each increase was 3% to 10%, depending on the raw material and labor content each product family required, and how much those costs increased.

Purchasing enjoyed an equal but opposite effect of inflation. They had to get quotes and requotes for all the materials, equipment, and so on. By the time management made a decision, the pricing was no longer valid, and the process would repeat. Annual pay increases were also double-digit. As great as that may sound today, at the time they barely kept pace with inflation-driven costs of rent, cars and all the other trappings of work life. Moreover, the cost to borrow money was sky-high. My first mortgage in the early 1980s was a fixed rate of 14.25%, which I was able to get only after paying two points.

Back then, thanks to years of significant inflation, the rampant assumption was prices would keep going up. Consumers stopped asking why, which resulted in businesses raising prices even when it was unnecessary. Inflation emboldened many to increase prices just because they could, thus escalating both the rate and duration of the phenomenon.

Yes, times were different. Being right out of school and considered a “young pup” (read: clueless), economics meant nothing to me. What did mean a lot, however, was trying to save a few bucks to buy something I wanted or needed, only to find inflation kept the object of my desire out of financial reach. No matter how hard I worked, I was always financially behind. And as much as sometimes I opine about “the good old days,” the one thing I am so glad to not experience or manage is inflation. During the mid-’80s the Federal Reserve changed monetary policy, with the primary goal to keep inflation low over time.

Which brings us to now. With a few more miles, and stubbed toes, under my feet, I am no longer a young pup and more of an “august observer.” And to this observer, many signals indicate some countries, and our industry, may be on the cusp of once again experiencing a period of high inflation.

Some politicians do not fully understand the complex supply chains those in tech utilize to create, develop and bring products to market. But a tariff here, or a trade restraint there, can ricochet through a supply chain and the larger economy, creating collateral damage that could include significantly higher prices on items never intended to be impacted. Such supply-chain disruptions are a driver of inflation. And, from the experiences of 40 years ago, once inflation starts, it is tough to rein in, not to mention costly.

In the 1970s, under President Richard Nixon, Treasury Secretary John Connolly, who was a politician, not an economist, pressured the Federal Reserve to use monetary policy as a tool to boost the economy and create jobs and fuel a bull stock market. This contrasted the Federal Reserve’s charter, which is to manage the economy for stability and prevent short-term “boom or bust” cycles. That misguided monetary policy planted the seeds for the decade of double-digit inflation that followed.

Today’s events recall that era. Politicians appear to be more comfortable trying to use monetary policy for purposes it was not intended. Monetary policy should be adjusted in reaction to global events and economic forces that may have been impacted by politics. Specific monetary actions should not be used as a political tool to influence non-economic global events. In the current global political environment, the lines are blurring, and actions taken for what may not be optimum long-term economic reasons.

Remembering those long-ago and costly economic times makes us old folks tremble. The current generation of young pups is likely unaware what high inflation can do to their (already stretched) budgets. And we all need to understand that good business decisions become much more challenging when product and labor costs and availability – not to mention access to loans – are unstable because of high inflation. That is the challenge I fear we all may relearn the hard way, as economic sabers are rattled and economic policy tweeted.

Peter Bigelow is president and CEO of IMI Inc. (imipcb.com); This email address is being protected from spambots. You need JavaScript enabled to view it.. His column appears monthly.