From the US and Europe to Japan, cutting-edge technology is always on the move. Is it Taiwan’s turn to assume the mantle?

The technology arc in the interconnect manufacturing industry is once again in motion. Twenty years ago the United States and Western Europe were the sources of innovation in manufacturing processes.

New equipment and technologies were developed in cooperation with leading American and European fabricators such as IBM, Hewlett Packard and Cray Research. Independents such as Advanced Circuits for wireless and Photocircuits in automotive circuit boards led the way in developing new manufacturing processes. Today, all of those names are history in the interconnect manufacturing business.

The arc then shifted to Japan, where IC packaging substrates and high-density consumer electronics became the technology drivers. Designs for fine pitch rigid/flex, organic packages, and notebook computers drove high density interconnect with a wave of specialty technologies. Embedded components began to be used in consumer products. Japanese companies are still driving much of the technology, but are doing it in an accelerating manner offshore.

Today, Taiwan is set to take the torch. The first tier Taiwanese PCB manufacturers are now in discussions with key customers on pushing closer to 10µm lines and spaces for interconnect substrates containing active components. Shorter signal paths, profile reduction, and product security all play a factor in this drive. If you were to ask an American or European fabricator to build such product, they would look at you like a Martian. In Taiwan with ready capital, government support, and an already outstanding technology base, they would ask, “How many sets?”

The distance between Taoyuan County, where much of the interconnect industry is located, and the Hsinchu Science Park, where much of the R&D and Taiwan’s formidable semiconductor industry resides, is less than 70 miles. This does wonders for technology development.

But the greatest drivers are still external. It is the North American OEMs driving the technology, and the leading European, American, and Japanese suppliers who are at the fore in materials, process and technology. But it is Taiwanese companies synthesizing these ingredients into the next generation of technology.

Business conditions. Businessmen talk. Information is a commodity, and the first question after catching up is usually “how’s business?”

From reports all over Asia, business is very soft. The top tier interconnect manufacturers are off by 15 to 20%, while many others are down by 25 to 30%. A few, especially commodity manufacturers in China, are down as much as 40%. International materials suppliers are down 15 to 20%, and few are holding their own simply by partnering with the right circles. Small hole drill bit usage in Asia is down 25%, while solder mask usage is down as much as 30%.

Several new plants are being designed and built, including a very large project at KCE. AT&S’ new HDI plant in Chongquing is just about to come on line, while Ibiden is expanding in Malaysia. There is a strong trend of Japanese manufacturers moving new production away from China because of the current political environment.

The tension between China and Japan is also affecting current business. There have been reports of Japanese components, machinery and materials mysteriously tied up in customs, which is now affecting production and deliveries to end-users. This could be a double-edged sword if this trend continues and factories are forced to slow or stop production because of shortages.

There is the Apple Circle, the Samsung Circle and the Intel Circle. If you know the secret handshake, your company is doing okay, but even then there is the risk of allowing too much of one’s capacity to be driven by a few customers. Forecasts for 2013 are more positive, but there is a long way yet to go. The European economic slowdown and uncertain demand in North America are also impacting the industry, while weak automotive sales in China and consumer conservatism in that market have not been able to take up excess capacity.

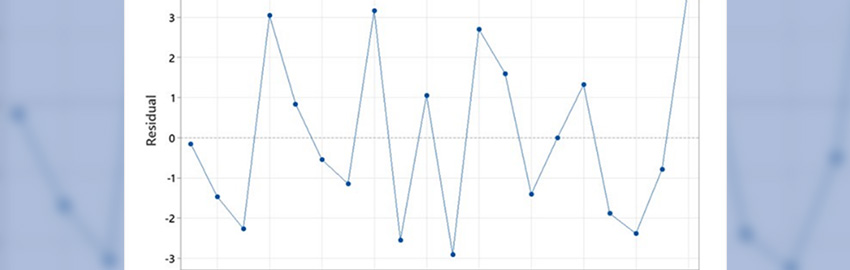

Technology improvements. The most striking news in the technology of the interconnect was sub-10µm lines and spaces.

A very few companies have been manufacturing limited quantities of 15µm line/space product, primarily for packaging applications, but now there is a roadmap including both 10µm geometries and embedded actives.

This will be another phase shift in the materials and equipment of interconnect manufacturing, as the requirements approach those of what was in the semiconductor field 30 years ago. A number of imaging equipment manufacturers have been developing or delivering stepper systems, while wet process suppliers have been inching toward these demands as well. Completely new processes will have to be developed, and it is likely that process chemistry will also require ultra-pure formulations to prevent contamination.

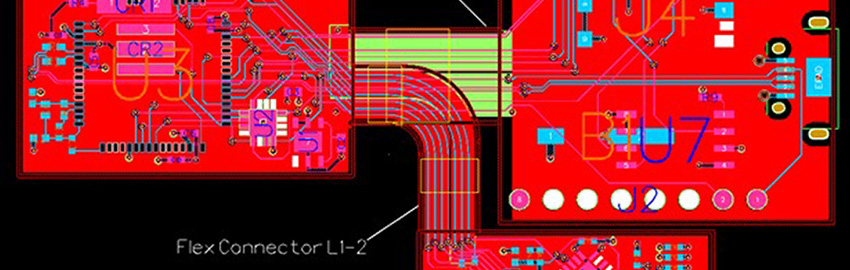

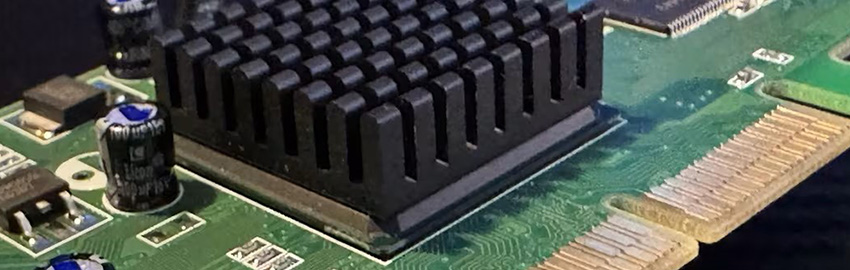

The influence of 3D IC packaging on the interconnect was also a major topic of discussion. Chip-scale packaging is going mainstream, and all of the factors of substrate stability, 35µm pitch, and how to process organic substrates for 3D applications are at the top of the list. TSMC and other fabs will begin production in the first quarter 2013, so the issues are real and immediate. Design tools for 3D IC substrates are in place, and several interconnect manufacturers have established dedicated production lines, but the next year will be one of challenges as volumes rise.

Thermal, mechanical and electrical integrity are more important than ever, as stacked chips present challenges to the interposer. This then goes back to integrating passive devices within the package as well, and the issue of known good die becomes critical. The interconnect is becoming the device.

3D IC is also shaking up the OEM world. Fabless semiconductor companies are finding themselves at a distinct disadvantage, and a number of business models have been changing. Suddenly, major corporations such as Qualcomm, Broadcom and AMD are more vulnerable and constricted in their ability to move rapidly with new designs.

There were fewer Westerners than ever at this year’s TPCA, and yet to understand the means of production, this is one of the best venues in the world. If we do not understand how the product is built, we cannot build the next generation. There has been a move toward reshoring, or returning production to North America and Europe. The reasons range from a less competitive China to quality to being closer to end-users. But if the infrastructure does not exist for a critical technology such as the interconnect, what happens?

A final note. John Mitchell, the new president of IPC, was everywhere at TPCA, meeting with as wide a range of stakeholders as possible. He is a listener and a doer and has already had a very positive impact on the direction of the organization. In times when the challenges are great, it takes cooperation and collaboration to make significant progress. It is good to see that the suggestions of stakeholders are being considered and addressed and to see real world results.

Matthew Holzmann is president of CGI Americas (cig-americas.com); This email address is being protected from spambots. You need JavaScript enabled to view it..