The printed circuit board will continue

to be the “work-horse” of interconnection technology.

Interconnecting substrates provide circuit signal matching, thermal management, mechanical support and electrical functionality. Standard organic substrate boards have been, and will continue to be, the “work-horse†of interconnection technology for surface mount and mixed technologies (SMT and through-hole), accounting for more than 90% of today’s interconnecting structures.

Telecom, computer, entertainment and Internet-enabled devices are driving technology requirements for printed boards and electronic components, and even some optoelectronic parts (to increase bandwidth). Printed boards of the future must offer increased wiring density, better high-frequency characteristics, thinner dielectric layers and lower weight. Greater emphasis is also being placed on the circuit performance contribution of the organic substrate.

Designs become more difficult as frequency increases, and as processing speeds continue to accelerate, so will the pressure to lower the dielectric constant and the dissipation factor of the material. Meeting cost expectations, while trying to meet the design intent, for high-volume production continues to be a major challenge faced by the industry. Add to this the need to manage legislative demands posed by Europe, Asia and various states in the U.S., and you have a new set of requirements for organic materials.

The 2007 iNEMI Roadmap looks at organic interconnect technology, projecting industry needs to the year 2017. It identifies the technology challenges that need to be met in the short term, along with the longer-term issues, and also discusses some of the business issues that industry must address. This article covers some of the highlights of the organic interconnect chapter of the roadmap.

Rigid Board Substrates

Table 1 [PDF format] represents the status of technology in the rigid board industry for 2006. As shown here, 100 µm conductor (line) width and spaces on conventional FR-4 processes are available in limited production, and 40 µm lines and spaces are available only from very select fabricators. Microvia technology is used on most of the package and module substrates; however, it is not used on conventional printed boards, because products in those markets allow more liberal tolerances. This fact is changing as designers find that they can reduce layer count by adding high-density interconnect (HDI) layers. Microvias today show up in threshold and state-of-the-art products, as exemplified by their use in high-end laptop computers and video recorders, and in special niche markets. These products are being produced with >75 µm lines and spaces. Table 2 [PDF format] shows the current state of package and module boards.

In today’s market, traditional FR-4, which at one time represented 85% of the resin system used to produce copper-clad laminate, is gradually disappearing. The replacement is still an epoxy, resin-based material; however, the fillers and proportions of other resin make for a variety of choices. The characteristics of epoxy resin systems will continue to evolve.

There are many requirements for rigid printed boards, such as conductor width, hole diameter, capture and target land diameter. Table 3 [PDF format] lists examples of the properties that represent conventional and build-up technology, projected through 2017.

Components

The total number of components attached to a single assembly is growing, as is the number of functions per device. Components are more complex than ever before, and the use of high-I/O components is growing at a rate of 30% to 70% per year. The use of high I/O components creates the challenge of routing all the required signal, power and ground I/O pins to the printed board without increasing board complexity and, therefore, cost. Thoughtful component package pin assignments, along with package configuration considerations (pitch, ball size, ball count and depopulation) can go a long way toward making board routing easier.

This increased complexity and I/O count has led component manufacturers to reduce the contact pitch on perimeter lead devices, which represents challenges for both assemblers and bare board manufacturers. Assemblers have handling, alignment and co-planarity problems while board manufacturers have problems with land size, soldermask, flatness, surface finish and electrical test.

Growth in the use of array type components, such as BGAs, CSPs and direct-attached flip chips, is providing an increasing challenge to the interconnecting substrate manufacturer. These area array components drive the need for very small vias on tight grids, as well as fine line wiring with equivalent spacing, and on multiple levels.

Microvia Technology

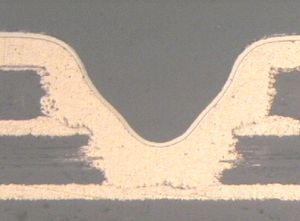

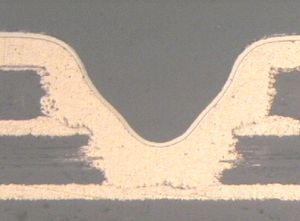

The technologies used for microvia formation in build-up constructions have matured significantly, with commensurate growth in infrastructure development. Laser via formation has taken hold in a number of manufacturing sites. This does not imply a reduction in the volume of photovia product but, rather, that fabricators who are newly adopting build-up processes have found it more cost-effective or versatile to laser drill. In addition, laser drilling now encompasses traversing more than one layer (Figure 1).

|

FIGURE 1. Microvia traversing down to layer three of a multilayer structure.

|

The mechanical drilling industry also continues to keep pace with the needs of manufacturers by providing drill bits that are very small and in a bucket shape, where the larger part of the bit creates an opening at the top of the via hole that allows robust plating techniques of the microvia. Using these drill bits requires step drilling from external layers to the first internal layer.

Flexible Substrate Technology

Flexible circuitry needs were roadmapped for the first time in the 2004 iNEMI Roadmap. Substrate technology requirements for interposer packaging needs were covered at that time, as were product board flexible substrates. There are some new uses of these materials for which the unique properties of un-reinforced materials have a better chance of meeting product requirements (at a reasonable cost), especially with printed technology rather than etching away original copper foil.

Flexible printed boards are most likely to be used where interconnect structures must survive severe flexural lifecycles and torque (e.g. hard disk drives, printers), or where shock and vibration absorption are required (e.g. military applications). Most flexible printed boards are not subjected to dynamic flex requirements but need flex to be installed in 3D static shapes, a feature that assists miniaturization in hand-held electronic equipment and certain medical applications. Specialty applications also include membrane switches (key pads) and single-layer structures serving as superior alternatives for wire harnesses.

The disadvantages of these products are closely related to their flexibility advantage: dimensional instability, unique tooling requirements and uniqueness of applications that add engineering costs. High Tg flex substrates suitable for soldering (typically polyimide) are more expensive than comparable rigid substrates.

Because of the material capability, new markets are being explored for flexible and non-flexing applications. Some of these are in the automotive sector; however, medical and telecommunications are close behind. Since polyimide materials are more expensive, the cost-driven markets look for ways to use polyester as the basis material in those applications where severe temperature exposure is not an issue. New processing techniques are being implemented where the conductive pattern is screened on the materials and (after being cured) has the components attached, usually with conductive epoxy.

Table 4 [PDF format] provides an overview of the current status of some of the key substrate characteristics of the flex circuit industry.

Dielectric substrates are selected based on needs such as flexibility, dielectric properties, dimensional stability and strength, CTE, thermal and chemical resistance, and cost. Dielectric resins may be thermosetting or thermoplastic, and they may be reinforced by glass or organic fibers such as aramid. The most common flex structures use thermoplastic, non-reinforced dielectric film such as polyimide or polyester.

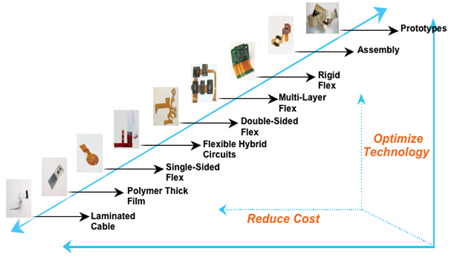

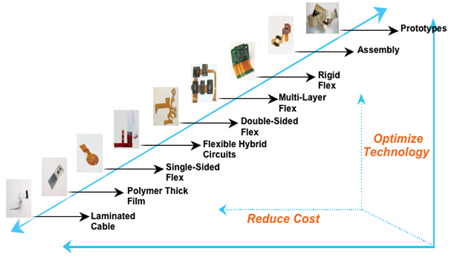

Polyimide is chosen for its good flexibility, high temperature (200 to 240°C) compatibility, low CTE and dielectric properties. Cost and moisture absorption are drawbacks. However, advances in polyimide polymer compositions have yielded materials that have less than 1% moisture absorption, compared to standard polyimides that have 2.5% to 3% moisture absorption. Polyester is chosen for good flexibility, low CTE, good chemical resistance and low cost, but polyester cannot be processed much above 100°C. See Figure 2 for a summary of flex circuit product types.

|

FIGURE 2. Flexible circuit hierarchy of product and technology choices.

|

Embedded Components

The electronics industry has had the ability to embed passive components in interconnect substrates for many years, but the market for this technology has been small. However, with the advent of wireless technology and high-speed/frequency circuits, passive components that are buried inside the PCB are appealing for the wiring density and electrical performance advantages they provide. As a result, is it paramount that the infrastructure to support this technology evolves.

It is no longer just saving assembly real estate that is the issue; it is the fact that performance of the electronic package, module or unit requires that resistor and capacitor devices be close to the power I/Os of the semiconductor. This phenomenon requires that these elements are a part of the PCB, making the board truly perform a circuit function.

The decision to integrate or embed components must be made early in the design process. Some components are easy candidates for integrating into the multilayer structure. For others, it is more difficult to rationalize the added performance value compared with the extra processing steps needed to achieve the desired results. The cost trade-off discussions are ongoing and will continue for a number of years.

There is no doubt that the technology of including resistive material or capacitive structures in the substrate will become a way of increasing the performance of the product being designed. However, CAD systems and board fabrication infrastructure are not as ready as they need to be in order to have full implementation capability for using embedded passives. Nevertheless, both Europe and Asia are making some significant strides toward using this technology to increase density advantages.

Market Leadership

The North American substrate industry is concerned with the continuing loss of market share to the Far East. Japan is clearly the leader in microvia technology, and although the North American printed board fabricators are manufacturing a few microvia boards, there is no indication they are investing in this technology. According to BPA, 57% of world PCB production is in Asia, excluding Japan. Japan makes up 23% and North America 11%. North American manufacturers today dominate the high-performance printed board market, but they may not maintain that lead. The Chinese are investing heavily in PCB capacity and may have the tools in place to capture a large piece of this business, but it is still uncertain if they will have the necessary technical resources required.

Many may disagree with the metric “technology leadership†in the printed board industry; however, expertise has historically been measured by feature size manufacturing capability – he who can manufacture the smallest feature is the technical leader. Today, the feature size technology leader is, inarguably, Japan. U.S. printed board manufacturers are the technology leaders only if leadership is measured by layer count, manufacturing capability or by materials processing capability. Some OEMs are forecasting a layer count reduction in their products in order to reduce cost. If the layer count reduction is real, it may mean that the North American fabricators will lose additional market share.

Technology requirements are different in each end-use environment and are based on very specific functions that the interconnecting structure and assembly must perform. At times, the lowest cost substrate (paper base, single-sided phenolic, no plated through-holes) will suffice for a product that will see very narrow temperature swings or has the thermal characteristics properly managed. The substrate is only performing an interconnecting function, and the electronic components have sufficient compliancy in their lead structure such that, as the parts heat up or cool down, there is no impact on the reliability of the joint created between the interconnecting structure and the electronic components.

Research and Development

One final area of concern relates to the development of new materials and manufacturing technologies for future products. As OEMs outsource production, they are investing less in manufacturing technologies and materials, and more in the development of new products. However, it is still necessary to advance the technology – innovations in materials, combinations of components and their interconnecting structures.

These innovations are being delegated to material and equipment suppliers. They must do the research and commercialize it to provide new processes, equipment and tools to be used by the manufacturing industry. These companies have traditionally operated with much thinner margins than the OEMs and have little or nothing to invest in R&D. As a result, there is concern about how the necessary innovations will be made, and who will make them. Several OEMs are recognizing that their technology/cost needs are not being met. Will the industry find a solution to meeting these needs? Stay tuned for the 2009 iNEMI Roadmap! PCD&M

For additional information about the iNEMI Roadmap, go to inemi.org/cms/roadmapping/2007_iNEMI_Roadmap.html

Jack Fisher is a consultant at Interconnect Technology Analysis and chaired the organic interconnect chapter of the 2007 iNEMI Roadmap. He can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it..