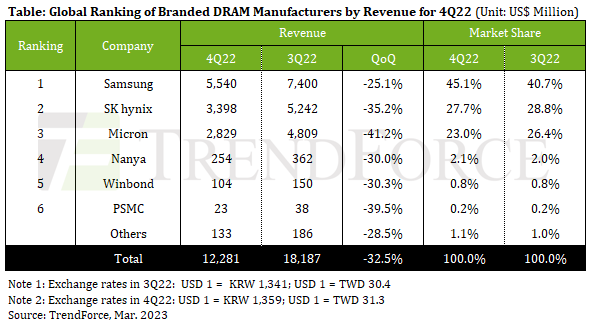

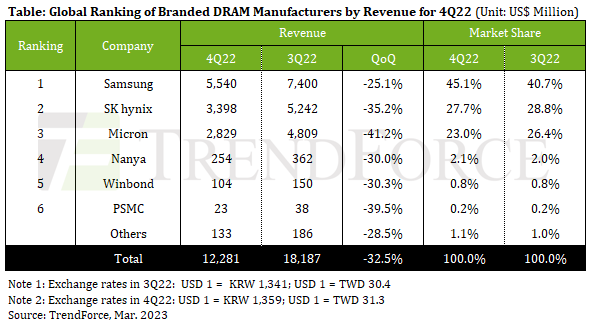

TAIPEI – Global DRAM revenue fell by 32.5% quarter-over-quarter to $12.28 billion, per TrendForce research. The fourth-quarter decline is larger than the QoQ decline of 28.8% for the third quarter and comes close to the QoQ decline of 36% for the final quarter of 2008, when the global economy was in the midst of a major financial crisis.

The main cause of the steep revenue drop was the plummeting overall ASP. DRAM suppliers experienced a rapid accumulation of inventory in the third quarter due to a freeze in buyers’ demand. Subsequently, suppliers were much more energetic in price negotiations for fourth-quarter contracts as they were struggling for market share. Among the major categories of DRAM products, server DRAM suffered the sharpest price drop in the fourth quarter. Contract prices of DDR4 and DDR5 server DRAM products registered QoQ drops of 23~28% and 30~35% respectively.

The top three DRAM suppliers – Samsung, SK hynix and Micron – all posted a significant QoQ drop in revenue for the quarter. Samsung was the most aggressive in the price competition during the quarter, so it was able to raise shipments despite the general demand slump. Samsung’s DRAM revenue came to $5.54 billion with a QoQ decline of 25.1%. Even with this result, Samsung had the smallest revenue drop among the top three. SK hynix posted a QoQ drop of 35.2% in DRAM revenue to reach around $3.4 billion. On the whole, the two South Korean suppliers ramped up shipments because the quarter was the final quarter of the 2022 fiscal year for them. However, the large price concessions that allowed for more shipments also caused their respective ASPs to plunge. This, in turn, was reflected in their revenue declines.

Micron's DRAM revenue fell by 41.2% QoQ to reach around $2.83 billion. Micron’s fiscal quarters do not align with calendar quarters and end earlier compared with other suppliers’ fiscal quarters, so the company recorded a larger drop in shipments and thereby suffered the largest revenue decline among suppliers. Regarding profitability, DRAM suppliers on the whole experienced a massive contraction in operating margin in 4Q22, so they are expected to turn from profit to loss for the first quarter of 2023.

Regarding the top three suppliers’ plans for developing production capacity in 2023, Samsung is going to optimize the legacy production lines of Line 15, so this fab will experience a marginal drop in DRAM wafer input. The newly built P3L, which is the focus of Samsung’s capacity expansion efforts, has begun pilot production this quarter and will be mainly responsible for driving the growth of the supplier’s total DRAM wafer input for this year.

SK hynix announced last quarter that it will be cutting production, so its DRAM capacity utilization rate is projected to slid from 92% this quarter to 82% in the second quarter. Among SK hynix’s fab sites, the base in the Chinese city of Wuxi will be making the largest production cut. Conversely, SK hynix maintains its plan to slightly raise production at M16 in South Korea because this fab deploys its advanced DRAM manufacturing process.

Micron is scaling back production at OMT (its operation in Taiwan) and the Hiroshima base simultaneously. Micron’s DRAM capacity utilization rate has fallen to 84% and is expected to stay at this level through 2023. On the technology front, Micron has begun mass production with its latest 1beta nm process. OMT will also deploy the 1beta nm process within 2023, with wafer input scheduled for the middle of the year and mass production taking place during the second half of the year.