LYON, FRANCE — The global advanced IC substrate market value is anticipated to rise from $15.8 billion in 2021 to $29.6 billion in 2027, according to Yole Intelligence's annual Status of the Advanced IC Substrate Industry 2022 report.

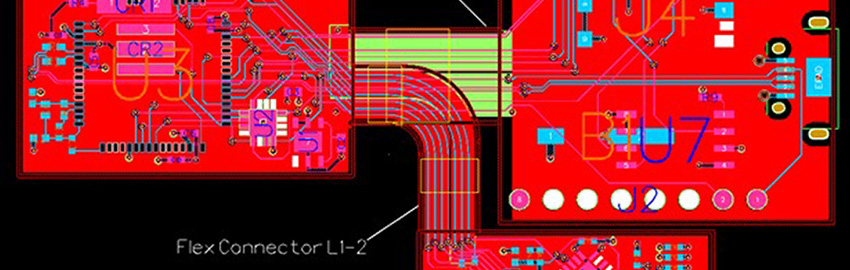

This year's report focuses on three advanced IC substrate platforms, advanced IC substrate, circuit board SLP, and ED. It delivers an overview of market trends, forecasts, technology roadmaps, and supply chains for each substrate platform. It also gives an overview of Chinese IC substrate makers and how they affect the market.

“At Yole Intelligence, we expect the global advanced IC substrate market value to have an 11% CAGR from US$15.8 billion in 2021 to US$29.6 billion in 2027,” explains Yik Yee Tan, Senior Technology and Market Analyst at Yole Intelligence. “This evolution is mainly driven by high demand in the mobile & consumer, automotive & mobility, and telecom & infrastructure markets.”

The main substrate technology trends are increasing complexity with larger areas, more layers and finer pitches, and reducing line/width spacing (L/S) by adopting approaches like SAP , mSAP , or amSAP . SLP technology developments remained steady in recent years, while ED technology aims to enable embedding multiple dies to serve more applications.

- IC substrates are mainly driven by AP , baseband for FC CSP and 5G wireless devices, HPC , GPUs , servers, and the automotive industry for FC BGA . The market value is expected to have a 12% CAGR from $12.6 billion in 2021 to $24.3 billion in 2027.

- SLP circuit boards are mainly used in high-end smartphones, with $3 billion in revenue in 2021 and a CAGR of 6.7% to $4.3 billion by 2027.

- ED in laminate substrate is relatively new to the market but will have a CAGR of 39%, reaching $1.0 billion in 2027 from $142 million in 2021.

The IC substrate market is optimistic, especially in FC BGA with ABF substrate. Companies announced unprecedented investment and capacity expansion in 2021 and 2022, exceeding $15.5 billion. More investments are in Asia, with almost 46% in China. AT&S in Austria is the biggest investor, focusing on FC BGA, aiming to become a top three IC substrate supplier soon. The investments have not come entirely from companies but also partially from their customers, who are co-investing with substrate players to ensure their supply. In these cases, capacity is allocated to those customers that invested, so the increased capacity does not help smaller customers.