BANNOCKBURN, IL — IPC's first-quarter global electronics industry survey shows worldwide business environment scores as positive and strengthening.

The outlook for the next six months and 12 months climbed to their highest levels since the quarterly survey was launched in July 2017, the trade group said.

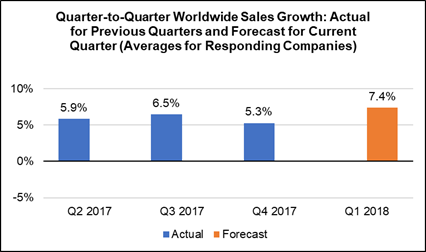

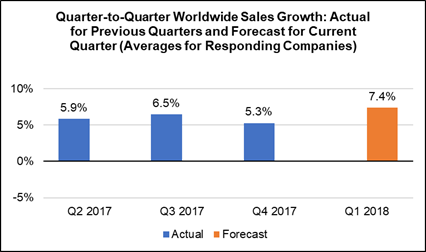

Average sales growth for the responding companies has been positive for the last three quarters and is projected to exceed the last year’s growth rates in the first quarter of 2018. Average sales growth predicted for the first quarter is positive in all regions and all industry segments. Regionally, companies in the Americas are predicting the highest average sales growth, IPC said.

The current business environment is moving in a positive direction based on responses to the Q1 2018 survey in January. It is positive for all industry segments, but strongest for OEMs and PCB fabricators.

Eight key business indicators are measured and weighted to produce the composite score index for the current direction of the business environment. As of Q1 2018, growth in sales and orders are the strongest positive drivers, but the direction of order backlogs and profit margins are also positive contributors to the first-quarter worldwide score. These drivers prevailed over the quarter’s negative business indicators, which include higher labor and material costs, challenges in recruiting workers, and rising inventories.

First Half Outlook

As of March, the expected direction of the business climate worldwide for the first half of 2018 is positive and substantially stronger than survey participants’ expectations in the last two quarters. Each of the seven indicators of the business climate for the next six months that can be reported is positive. These indicators – which are measurable results from the participants’ own businesses – include sales, production, markets, prices of the companies’ products, capital investment, exports and the number of full-time employees. (While the expected direction of prices is factored into the composite score, results are not reported for this indicator in adherence to US antitrust guidelines.)

Sales, production and markets are the leading positive drivers of the six-month business outlook in all regions. Respondents in Asia have the strongest expectation for market growth. All industry segments expect all the key business indicators to continue strengthening over the next six months, but subtle differences are seen in the degree of strengthening in exports, which is highest for OEMs, and in capital investment, which is highest for PCB fabricators.

12-Month Outlook

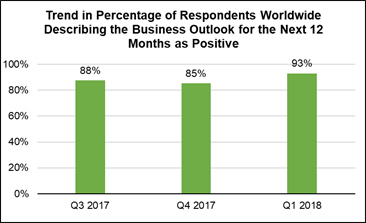

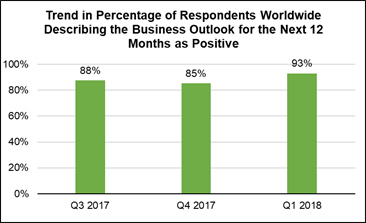

Composite scores on the business outlook for the next 12 months have been strong in each of the last three quarters, but the Q1 score is the highest to date. Scores on the 12-month outlook are strong in all regions and industry segments. They are highest for companies in Asia, and for PCB fabricators and OEMs.

Ninety-three percent of all survey respondents worldwide, as of January 2018, described the business outlook for the next 12 months as positive. The percentage was high in every region and industry segment.

“The industry’s positive outlook has been strong since this program was launched last summer, but the first-quarter 2018 results are extraordinary,” said IPC’s director of market research Sharon Starr, who presented the findings at IPC Apex Expo in February. “This level of optimism was evident everywhere at this year’s Apex Expo.”