-

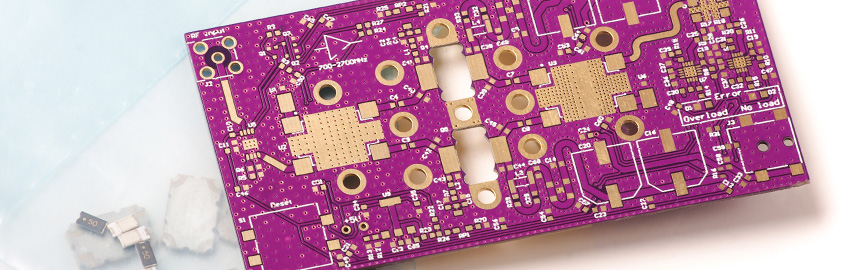

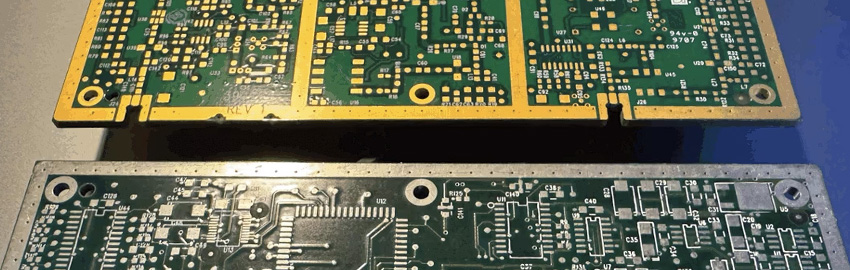

Choosing the Right Surface Finish

Balancing environment, shelf life – and cost. READ MORE...

-

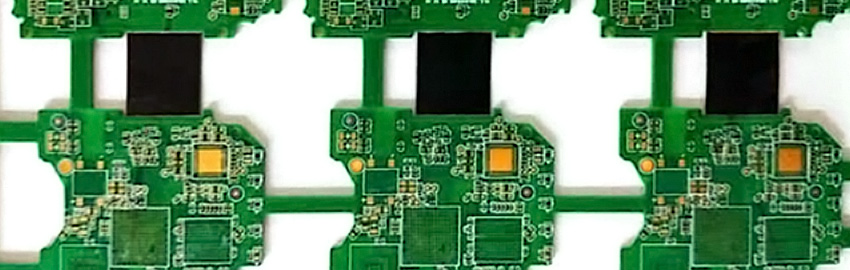

Elements of PCB Panelization

Panelize to optimize: faster builds, better boards. READ MORE...

-

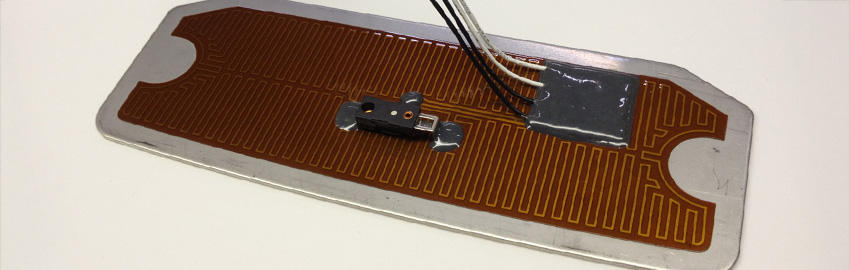

Flexible Heater Temperature Limits

How high can they go? READ MORE...

-

Collaborating with Service Bureaus

Time-to-market advantages encourage getting designs to scale quickly. READ MORE...

-

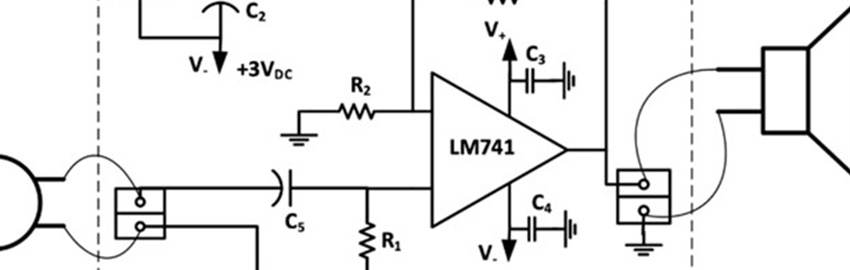

Optimizing Mixed Signal Circuit Designs

Navigating the analog and digital worlds. READ MORE...

-

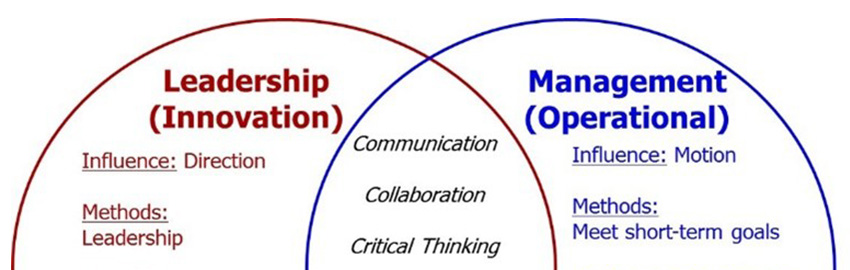

Developing Organizational Culture for Troubleshooting

Solving problems and adding value. READ MORE...

Homepage Slideshow

Choosing the Right Surface Finish

Balancing environment, shelf life – and cost.

Elements of PCB Panelization

Panelize to optimize: faster builds, better boards.

Flexible Heater Temperature Limits

How high can they go?

Collaborating with Service Bureaus

Time-to-market advantages encourage getting designs to scale quickly.

Optimizing Mixed Signal Circuit Designs

Navigating the analog and digital worlds.

Developing Organizational Culture for Troubleshooting

Solving problems and adding value.