Resolving return loss problems, one call at a time.

Usually when presidents retire, they have a party and go home. Not Ken Taylor. He has stepped down as head of Polar Instruments’ North American business unit three times and counting, but he keeps showing up to the office. Having an “enjoyable relationship with everybody makes it a great place to come to work,” he told PCD&F during a visit to Polar’s sales office near Portland, OR.

That elasticity has served both him and the company well. Polar’s approach to customers is help them all, whether they have recently purchased one of the company’s impedance or signal integrity software tools, or use older or obsolete products, or even don’t use Polar products at all. Says Taylor: “Our objective is to have a satisfied customer base that speaks well of us.”

In Portland, Taylor, Geoffrey Hazelett, vice president sales, and Lupita Maurer, product specialist, were eager to answer questions about the company Taylor says doesn’t have “a single unhappy customer or user.”

When asked about Polar Instruments’ biggest technology concern, Taylor didn’t hesitate: “Measuring loss. The industry can’t agree on a single standard and hardware used to achieve this.” The problem, he elaborated, is no one wants to “share their knowledge with no promise of ROI. Every three to six months it changes. Each methodology hasn’t lasted long enough to recoup investment.”

Hazelett added, “Insertion loss testing has seen a variety of conflicting and competing methods.” The tools all effectively measure loss, but vary significantly in methodology. “This is a bit of a problem for suppliers,” he says, with fabricators wanting to have the tools their customers require.

“We are being asked to chase every tail in the dog park,” Hazelett said. “And we are. There isn’t one broadly accepted test method all OEMs want to use. Developing new test methods is academically interesting,” but the downside is the lack of industry consensus on a common approach. Still, the type of computer modeling Polar performs for insertion loss and impedance does expedite getting designs to work.

Another technology concern, Hazelett said, is copper roughness. “At lower frequencies, it wasn’t a problem,” he said. But with “different loss profiles, the panel was etched longer.” While Hazelett calls this the fabricator’s challenge, he added a designer’s recourse is to talk to their board shop. “Polar reports are a bridge between design and fabrication,” Maurer added, saving headaches and time.

Polar develops tools for PCB design, fabrication and test. Hazelett said a bundle package with its Speedstack stackup design tool and the Si9000e inserion loss field solver is the firm’s most-popular product, followed by a controlled impedance test system and associated accessories, impedance modeling and documentation, and a time domain reflectometer (TDR).

Martyn Gaudion, CEO of Polar Instruments in the UK, also mentioned the company still sells its popular legacy product, the Toneohm, which performs fault finding on components on boards.

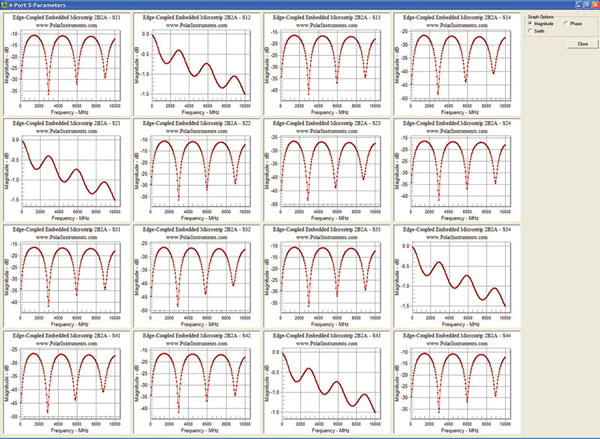

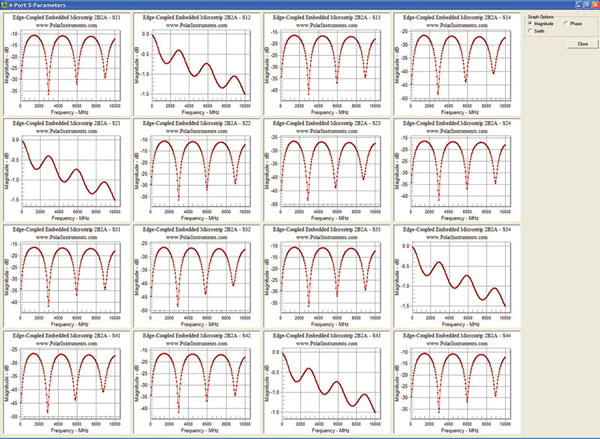

Figure 1. Polar’s popular Si9000e PCB transmission line field solver shows the full range of two- and four-port S-parameters in a single chart window.

No Cold Calls

The company’s livelihood is based on reputation. The firm never makes cold calls; potential customers always contact them first, or they meet at trade shows.

Polar has existed for 20 years, focusing entirely on fabrication until 2008, Taylor explained. As the story goes, the leap to the front-end came when it began getting calls from designers who’d talked to fabricators because fabricators were telling designers, “Polar says….”

Working with designers prepared Polar for the recession, Taylor continued, by broadening its reach and lessening its dependence on a single market. Previously, “fab was interested in impedance. That was all.” Since designers also cared about insertion loss and return loss, Polar developed a field solver for those models 10 years ago. Now fabricators also want them, expanding their testing by using what was traditionally a designer’s tool.

Hazelett added, “Back in 2007 and 2008, we had Si8000 and then came out with Si9000. When we brought out insertion loss, it propelled growth years in 2008, 2009 and 2010 because we released a new tool and opened up a new market for ourselves.”

Today, they “focus a lot of attention on designers” with “adapted/enhanced tools,” Taylor said.

On the business side, Polar says it has carved out a niche that doesn’t have much competition. Hazelett is seeing growth in the North American fabrication industry. “We don’t feel any pressure [in terms of] competitors, pricing and margins. The industry is quite stable,” Taylor said. “Growth is in line with the economy. I don’t see anything negative at all.” Sales are boosted by continued demand in military/aerospace spending, Hazelett added.

Hazelett says Polar has seen more onshoring recently, which “has resulted in more sales for [the US] and Asia offices.” (Polar Instruments is headquartered in the UK, and has offices in Austria and Singapore in addition to North America.)

Polar’s largest market in the US is the Silicon Valley, according to Taylor, where most of its customers have headquarters. The Midwest US and Canada are also big markets.

Ease-of-Use

Polar “approaches things by respecting customers’ opinions and basing product development on customer feedback,” said Hazelett. Polar is “approachable, honest, and open. We listen to our customers.”

As a result, the company plans to add a crosstalk feature to the field solver for both single-ended and differential pairs, and it has a tool in beta testing capable of performing several different S-parameter models or measurements – or both. The tool takes all the different models and actual measurements and displays them on one screen, Hazelett said.

“A lot of effort in the last few years has been moving forward insertion loss tools that are usable for designers and accessible for fabricators. A growing number of fabricators are stepping into the realm of insertion loss modeling,” Hazelett said. “That’s why we’ve kept the simple interface. Our tools are designed to be used by nontechnical operators. They don’t require an hour of setup to get an answer.”

According to Hazelett, Polar wants to be know for its fast, accurate and easy-to-use products. “Polar is like light bulbs: [Customers] need light bulbs to see in the factory.” Taylor said this also applies to their customer service attitude. Perhaps that’s why he keeps unretiring. He can’t see a future without Polar.

Chelsey Drysdale is senior editor of PCD&F/CIRCUITS ASSEMBLY; This email address is being protected from spambots. You need JavaScript enabled to view it..