CAMBRIDGE, UK – How far is printed/flexible electronics along the road to widespread adoption? The emerging manufacturing methodology, which replaces etched copper laminate with printed conductive inks on flexible substrates, offers multiple benefits, including flexibility/stretchability, the potential for low-cost roll-to-roll production, digital manufacturing/rapid prototyping, and improved sustainability. However, while undoubtedly the established manufacturing method for a small range of applications, printed/flexible electronics currently comprise a very small proportion of the total electronics industry.

Arguably the biggest success story of printed/flexible electronics is OLED displays, which are now ubiquitous in smartphones and widely used in TVs. However, with a few exceptions, such as foldable smartphone displays, these are neither printed nor flexible - while the emissive organic semiconductors can be printed, they are typically evaporated since that process is far more reproducible.

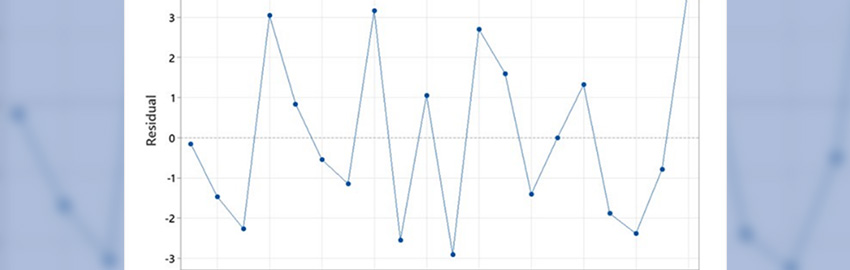

If OLED displays and the few established applications such as automotive seat occupancy sensors and glucose test strips are excepted, the printed/flexible electronics industry broadly follows the classic hype curve often used to describe the adoption of emerging technologies. Although clearly a simplification that aggregates many individual technologies and applications with different timelines, the hype curve nonetheless provides a helpful framework for characterizing industry sentiment.

A Compelling Vision

The original vision for printed/flexible electronics involved printing all circuit elements, including passive components such as resistors and capacitors, along with more sophisticated components such as logic and memory. Visions of printed electronic circuitry and devices such as photovoltaic panels, displays, and lighting rolling off production lines like newsprint captured the imagination. As such, printed/flexible electronics received considerable government and private funding, with many academic research groups exploring printable semiconductors for logic and photovoltaics.

This was followed in the 2000s and early 2010s by private investment into roll-to-roll production of both organic photovoltaics and printed logic, marking the zenith of the hype curve. Unfortunately, meeting market requirements of efficiency, durability, and cost proved challenging for both printed solar and logic, resulting in some cases of bankruptcy or strategic pivots.

Refining Product Market Fit

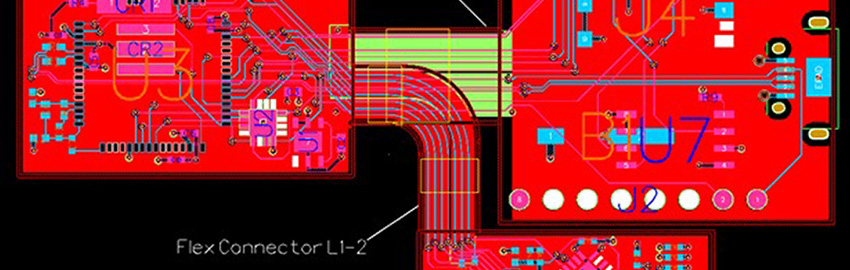

This realization that producing printed logic/memory that could compete with silicon integrated circuits was extremely challenging, along with the falling cost of conventional silicon photovoltaic panels, required adjustments from the nascent printed/flexible electronics industry. Rather than insist on printing the entire circuits, flexible hybrid electronics (FHE) gained traction as a compromise that combines conventional mounted components with printed functionality. Organic photovoltaics transitioned from aiming to compete on price to instead emphasizing other differentiators such as efficient indoor energy harvesting, lightweight for building integration, and easily tuneable designs.

Reaching the 'Slope of Enlightenment'

Recent years have seen much clearer targeting of printed/flexible electronics to specific applications where the technology offers significant enough benefits over the incumbent technology to merit adoption. Rather than 'here's a new technology with many widely relevant benefits', printed/flexible electronics companies instead offer specific solutions that happen to utilize printed/flexible electronics, often in conjunction with conventional electronics where appropriate.

As such, while the hype curve clearly hides many subtleties, IDTechEx regard the industry as a whole as on the 'slope of enlightenment'. A great example of this is successful commercialization after a strategic pivot, for example, a pivot from printed logic for RFID to producing transparent conductive foils for backlit touch interfaces that are now installed in mass-produced cars. Additional evidence for reaching this stage, where profitable use cases start to be found after the initial hype has faded, include the lack of new startups, with most early-stage players being 5-10 years old and have now identified the optimal product market fit. Furthermore, exhibited prototypes are now often produced in collaboration with a customer and generally show incremental improvements targeted at a specific application rather than novel capabilities. As such, expect to see an increasing commercial adoption of printed/flexible electronics across multiple sectors over the next few years, with applications ranging from wearable heaters to building leak sensors and from automotive touch interfaces to indoor photovoltaics.

Comprehensive Insight

IDTechEx has been researching developments in the printed and flexible electronics market for well over a decade. Since then, we have stayed close to technical and commercial developments, interviewing key players worldwide, annually attending conferences such as FLEX and LOPEC, delivering multiple consulting projects, and running classes/ workshops on the topic. "Flexible & Printed Electronics 2023-2033: Forecasts, Technologies, Markets" utilizes this experience and expertise to summarize IDTechEx's knowledge and insight across the entire field, with granular forecasts across 50 distinct applications and 40 detailed company profiles.

To find out more about this report, including downloadable sample pages, please visit www.IDTechEx.com/pe