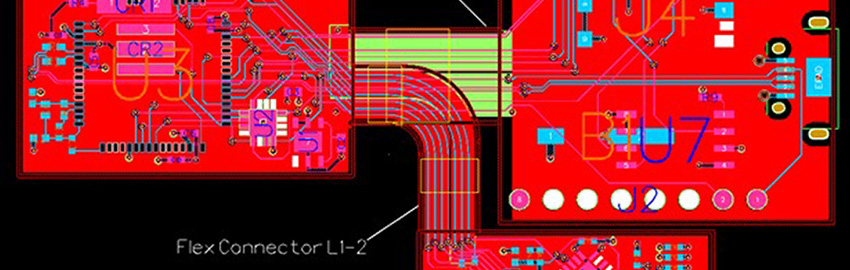

The global tin market faces a deficit, driven by heightened demand from the electronics sector, where tin is used for circuit board manufacturing while the total volume of metal production was insufficient. Consequently, tin prices peaked at $39,159 per tonne in November 2021, soaring by 79% from the beginning of that year. According to October World Bank’s forecast, the average annual tin price should drop from an expected $31,250 per tonne in 2021 to $31,000 per tonne in 2022.

LOS ANGELES, Jan. 04, 2022 (GLOBE NEWSWIRE) -- From January to November 2021, tin prices rose from $21,920 per tonne to $39,159 per tonne, reaching the highest level ever, according to a new report by a market research firm IndexBox. That spike was instigated by a deficit of the metal due to rising demand from the electronics sector, while global production stagnated over the past decade. Increased energy prices and high freight rates coupled with the limitation of metal smelting in China due to environmental restrictions further propelled tin prices.

Growing demand should promote investments in tin production, resulting in a slight price decrease. According to the October World Bank’s forecast, the average annual tin price will reduce by 0.8%, from $31,250 per tonne in 2021 to $31,000 per tonne in 2022. However, prices won’t return to pre-pandemic levels due to the high cost of energy resources.

Tin Consumption by Country

The global tin market dropped to $5.9B in 2020, waning by -11.3% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, indirect taxes and distributors' margins which will be included in the final consumer price).

The country with the most significant volume of tin consumption was China (181K tonnes), accounting for 48% of the total volume. Moreover, tin consumption in China exceeded the figures recorded by the second-largest consumer, the U.S. (30K tonnes), sixfold. The third position in this ranking was occupied by Japan (20K tonnes), with a 5.3% share.

In value terms, China ($2.4B) led the market, alone. The second position in the ranking was the U.S. ($521M). Japan followed it.

The countries with the highest levels of tin per capita consumption in 2020 were Singapore (1,124 kg per 1000 persons), Taiwan (Chinese) (646 kg per 1000 persons) and South Korea (261 kg per 1000 persons).

Global Tin Exports

Global tin exports shrank modestly to 186K tonnes in 2020, dropping by -1.9% in 2019. In value terms, the supplies reduced to $3.3B in 2020, IndexBox estimates.

In 2020, Indonesia (65K tonnes) was the leading exporter of tin, creating 35% of total exports. Peru (20K tonnes) ranks second in terms of total exports with an 11% share, followed by Malaysia (10%), Singapore (8.5%), Bolivia (5.5%), Belgium (5.4%) and Brazil (4.7%). Thailand (6.9K tonnes) followed a long way behind the leaders.

In value terms, Indonesia ($1.1B) remains the largest tin supplier worldwide, comprising 34% of global exports. The second position in the ranking was occupied by Peru ($351M), with an 11% share of global exports. It was followed by Malaysia, with a 10% share.

Last year, the average tin export price amounted to $17,516 per tonne, shrinking by -8% against the previous year. Average prices varied noticeably amongst the major exporting countries. In 2020, major exporting countries recorded the following prices: in Peru ($17,883 per tonne) and Singapore ($17,741 per tonne), while Malaysia ($16,853 per tonne) and Indonesia ($17,060 per tonne) were amongst the lowest.