When will it trickle down to the worker?

The Japanese government reported an economic expansion that began in February 2002 after a decade of lackluster growth during the 1990s. It is the longest expansion since the great “Izanami Boom” that lasted four years and nine months beginning in November 1965.

My statement about this new expansion is true considering the economic indices used by the government. Major banks and finance companies posted huge losses during the 1990s after the housing bubble burst in the 1980s, which led to many bankruptcies. The Japanese government formulated a plan with these institutions to restructure and rebuild the Japanese economy. It was expected that the total amount of debt for banks was more than a half trillion dollars. Several banks merged, and a majority of the larger banks disappeared from the Japanese financial landscape. The government provided cash infusion of more than tens of billions to support the restructuring of the remaining banks. The National Bank provided this infusion as a no interest loan over a long period of time. Banks went through a period of downsizing, and while it was a challenging period of time, they made a miraculous turn around.

All major banks reconciled the debts in a short period of time and returned the majority of the loans. Not only are the banks now profitable, but also most of the major manufacturers posted record incomes for last two quarters. The government feels this is the driving force behind recovery and continuous growth for the Japanese economy.

However, average workers feel differently about this economic boom. Many people lost their jobs over the last ten years, and those fortunate enough to continue employment have not seen a salary increase in the last 15 years. Neither did they recognize any interest income from saving accounts due to extremely low interest rates from saving vehicles.

Another big factor to consider is interest cost to the government. A lot of national bonds were issued to support the Japanese economy over the last 20 years. Presently, the total national bond debt is over 7 trillion dollars. It is historically the largest liability in the world, and it is almost ten times the annual tax income of Japan. How many years are needed to erase this huge debt? The Japanese government is optimistic about eliminating this huge liability, and believes it can retire the debt over the next 30 to 50 years by increasing taxes. But there are a couple of critical assumptions with their plan. They are assuming continuous growth for the economy and believe they can hold inflation at check. They prefer goods, services and properties to increase proportionality to salaries, and continue to monitor the situation. As the cost of petroleum and materials continuously increase, oil, material and mining companies enjoy the increased profits without making significant investments or increasing workloads. It looks like this manufacturing trend is not the most efficient way to realize increased incomes.

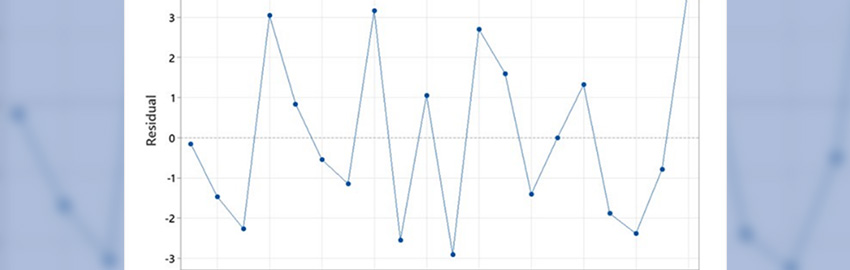

Government officials stated that if this economic expansion continues for one more quarter, it will be the longest growth since World War II. Unfortunately, bad news was recently reported. The rate of growth has decreased in the last six months. Machine orders from consumer goods companies declined 11.1% in the third quarter of 2006 compared to the previous quarter – the largest drop since April 1987. Several economists have commented that the peak of the growth was last August and that the Japanese economy will experience a slow season for a while.

In my opinion, it looks like another money game from the government, and the manufacturing companies must be included this time. We have to formulate our own survival plans because the government does not pay attention to small manufacturing companies.

Headlines

Japanese component supplier Murata began volume production of GaAs ICs with lead-free solder ball arrays. Production volume is expected to be 10 million units/month in April 2007. Murata also developed an ultra small gyro sensor, MEV-50A-R, with MEMS technology for moving equipment.

Samsung Electronics has developed a new multi-chip package for flash memories. One 1.4-mm height package has 16 chips in it.

Sumitomo Electric, a cable and flexible circuit manufacturer, founded a new subsidiary in Vietnam called Sumitomo Electric Interconnect Products. Manufacturing of many electronic products, including flexible circuits, will be transferred there.

Mitsubishi Plastic will increase production volume of polyetherimide film for cellular phone and car audio speakers.

Japanese electronic material and device supplier NEC Tokin is expanding its business of lithium ion batteries for back-up power sources of industrial applications.

CPCA released a five-year projection for PCB production in China with an expected 150 billion RMB in 2010.

OHT, a test equipment manufacturer in Japan, founded a joint venture company in Thailand to strengthen marketing and service capabilities in the area.

Japanese optical fiber and flex circuit manufacturer Fujikura has developed a new optical interconnection module for high-speed transmission of industrial robot applications.

Toppan Printing began volume production of color filters for eighth generation LCD manufacturing lines.

Asahi Kasei, a chemical company, installed a new manufacturing line of polarization film with wire grid systems for LCD panels. PCD&M

Dominique Numakura is president of DKN Research; This email address is being protected from spambots. You need JavaScript enabled to view it..