LEOBEN, AUSTRIA – AT&S reported fiscal fourth quarter revenue of €443 million (US$466.7 million), up 46% year-over-year.

For the period ended Mar. 31, profit was €42 million, an increase of 291% compared to the same period in 2021. EBITDA was €106 million, up 79%.

For fiscal 2022, AT&S posted revenue of €1.6 billion, up 34% year-over-year. Adjusted for currency effects, consolidated revenue rose 33%. Profit was €103 million, growth of 117% compared to fiscal 2021.

EBITDA was €349 million, an increase of 42%. The good result was positively influenced mainly by the significant increase in revenue, which compensated for startup costs in Chongqing and Kulim, Malaysia, as well as higher material, transport and energy costs. Moreover, research and development expenses were further increased. Currency fluctuations, in particular of the Chinese renminbi, had a negative impact of €20 million on the earnings development. Without these fluctuations, the growth rate would have been 50%. Adjusted for the startup costs, EBITDA amounted to €378 million, up 48%.

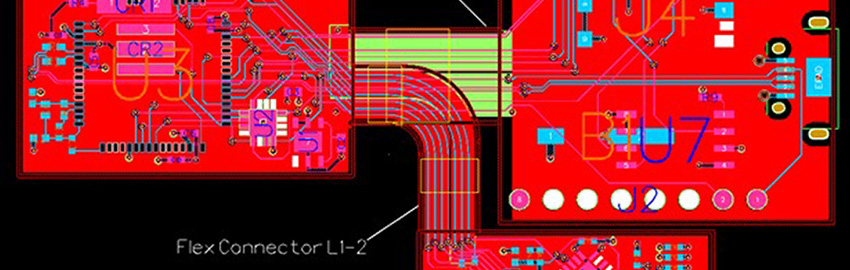

During the 12-month period, revenue grew on a broad basis, with the additional capacity for ABF substrates in Chongqing, China, proving to be the main driver. In addition, the broader application portfolio for mobile devices and module printed circuit boards contributed to revenue growth.

“In a volatile market environment, we were able to close the financial year with revenue and earnings at a record level,” said CEO Andreas Gerstenmayer. “This strong performance once again confirms our growth strategy and gives us reason to be optimistic about the future in the new financial year. We expect revenue of roughly €2 billion and an EBITDA margin between 23 and 26%. The growth course will also continue in the years to come. In the financial year 2025/26, we will generate revenue of approximately €3.5 billion and increase the EBITDA margin to 27 to 32%.”

Cash and cash equivalents increased to €1.12 billion as of Mar. 31, compared to €553 million at Mar. 31, 2021. In addition, AT&S has financial assets and unused credit lines of €337 million.

In fiscal 2023, AT&S will continue to concentrate on the startup of the new production capacities at plant III in Chongqing, push ahead the investment project in Kulim, Malaysia, and the expansion of the site in Leoben, Austria, and implement technology upgrades at other locations.

Planned investments amounting to €100 million of the investment budget for the financial year 2022 have been postponed to fiscal 2023.

In fiscal 2023, AT&S expects revenue of approximately €2 billion. For fiscal 2026, the company assumes revenue of €3.5 billion.

Ed.: €1 = US$1.05