-

Can Thailand Pad its PCB Gains?

2023 saw only a handful of fabricators gain ground, but SE Asia is primed to boom.

READ MORE... -

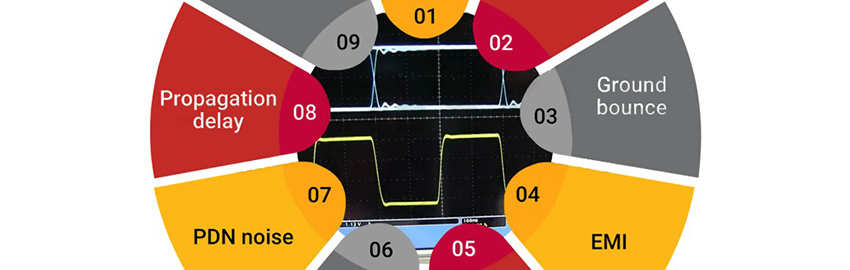

Managing Signal Integrity in High-Speed PCBs

Nine considerations to prevent signal degradation due to crosstalk and EMI.

READ MORE... -

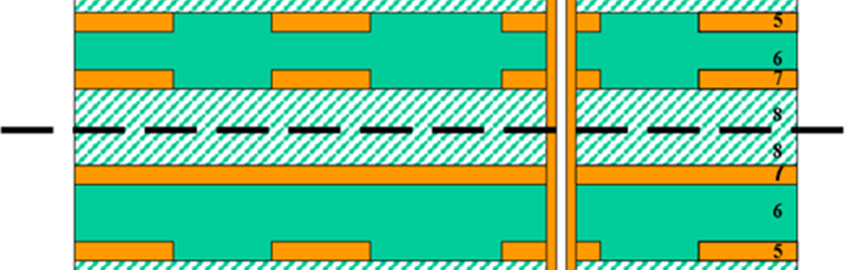

Balancing Stackups and Circuitry

A symmetrical build is one of the keys to minimize board warpage.

READ MORE... -

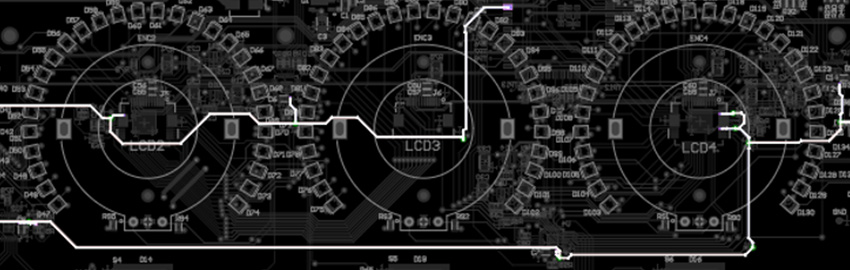

Driving PCB Manufacturing Innovation and Efficiency

Can a production fabricator thrive in Middle America? Through its novel automation, Summit’s Chicago plant is proof-positive.

READ MORE... -

Fundamentals of Signal Integrity at Various Frequencies

Tips and tricks for applications of all speeds, from 1MHz to gigabit level.

READ MORE...

Homepage Slideshow

Can Thailand Pad its PCB Gains?

2023 saw only a handful of fabricators gain ground, but SE Asia is primed to boom.

https://pcdandf.com/pcdesign/index.php/editorial/menu-features/18329-can-thailand-pad-its-pcb-gains

Managing Signal Integrity in High-Speed PCBs

Nine considerations to prevent signal degradation due to crosstalk and EMI.

Balancing Stackups and Circuitry

A symmetrical build is one of the keys to minimize board warpage.

Driving PCB Manufacturing Innovation and Efficiency

Can a production fabricator thrive in Middle America? Through its novel automation, Summit’s Chicago plant is proof-positive.

Fundamentals of Signal Integrity at Various Frequencies

Tips and tricks for applications of all speeds, from 1MHz to gigabit level.