TAIPEI -- Contract prices of NAND flash memory chips fell by nine to 10% in the fourth quarter due to oversupply conditions, TrendForce reports.

Prices of eMMC and SSD products also fell by 10 to 11% quarterly due to weaker-than-expected shipments of OEM devices such as smartphones, tablets and notebooks.

Overall fourth-quarter worldwide NAND flash sales were down 2.3% sequentially, the research group added.

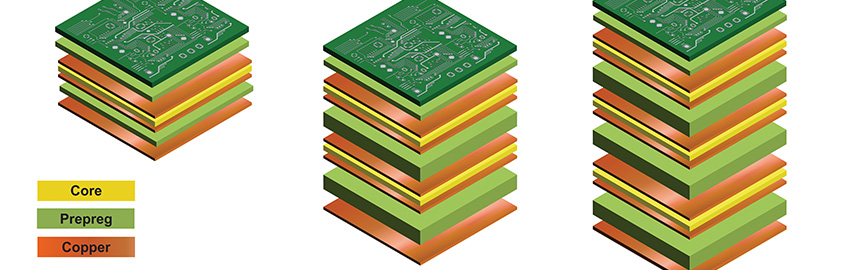

“Besides facing rapidly falling prices, the manufacturers have also reached a bottleneck in their process technology migration,” said Sean Yang, research director at DRAMeXchange, a division of TrendForce. Memory makers that are developing or producing 3D-NAND flash are encountering yield rate issues, with Samsung being the sole exception. As the cost reduction advantage associated with technology migration diminishes, branded NAND flash suppliers posted significant quarterly declines in both their revenues and operating margins for the fourth quarter of last year.

Samsung was one of the few manufacturers that experienced revenue growth in the fourth quarter of 2015 on account of its lead in 3D-NAND flash development and the rising sales of its high-density eMMC, eMCP and SSD products. In the fourth quarter, Samsung’s NAND flash business registered a quarterly bit shipment growth of 15% and a 10 to15% quarterly slide in the average selling price. The memory maker thus saw a quarterly revenue growth of 4.2% as well as a slight decrease in its operating margin.

Toshiba’s NAND flash business was affected by market oversupply as well. Compared with the prior quarter, the memory maker’s average selling price was 13 to 14% lower in the fourth quarter of last year. Toshiba only recently began the trial production of 3D-NAND flash. Moreover, the Japanese memory maker has found that its 15nm process offers limited cost reduction advantage. Thus, the company’s NAND flash business registered a decline in its operating margin for the fourth quarter.

SanDisk’s product mix adjustments have paid off as client and enterprise grade SSD sales make up an increasing share of the company’s total revenue. SanDisk also saw a 10% quarterly drop in both the average selling price and the average unit cost of its NAND flash chips in the fourth quarter of 2015. As a result, SanDisk’s gross margin reached 43% in the fourth quarter – on par with the previous quarter.

Compared with the third quarter, SK Hynix’s fourth-quarter NAND flash revenue fell by 9.3% to $841 million. The South Korean memory supplier also saw a 4% bit shipment growth and a 15% slide in the average selling price. As tablet and smartphone shipments from strategic clients are expected to suffer a huge drop in the first quarter, DRAMeXchange projects SK Hynix to post a 10% quarterly decline in bit shipments as well.

Set against the previous fiscal period, Micron’s bit shipments for the first fiscal quarter of 2016 (from September to November last year) registered a 6% quarterly increase, while its average selling price dropped by 7% and unit cost fell by 6%. Micron’s revenue for the first fiscal quarter of 2016 therefore arrived at $1.15 billion, up 1.9% from the prior fiscal quarter.

Intel’s major Enterprise-SSD customers pulled inventory in advance during the third quarter. Consequently, Intel’s bit sales grew 10% quarterly in the fourth quarter of 2015. However, the oversupply in the fourth quarter resulted in a steeper decrease in the average selling price, causing Intel’s revenue fall slightly by 0.2% quarterly to $662 million.