Led by wearables, IoT will intensify the designer’s packaging choices.

The electronics industry is always looking for the next “killer application,” and much of the buzz is now about the “Internet of Things” and promised growth. Market projections vary widely in both dollars and units. IDC expects the global Internet of Things (IoT) to grow by more than $5 trillion over the next six years.1 Strategy Analytics projects that the number of connected devices will increase from 12 billion at the end of 2014 to 33 billion devices in 2020. And Gartner calls for a thirty-fold increase, to 26 billion units, between 2009 and 2020.2

But what does this mean to the electronics industry, or more specifically, the semiconductor packaging and assembly segment?

IoT is the “interconnection of uniquely identifiable embedded computing devices within the existing Internet infrastructure.” Basically this means a lot of connected devices, including sensors, sprinkled around from everything from the milk carton in your refrigerator to the thermostat in your home or office.

But it is more than just a lot of sensors or RFID tags. IoT includes information regarding transportation of goods, traffic patterns, environmental conditions, and many other details not even developed yet. It includes data gathering through wearable electronics activities, medical conditions, and even people’s sleep habits.

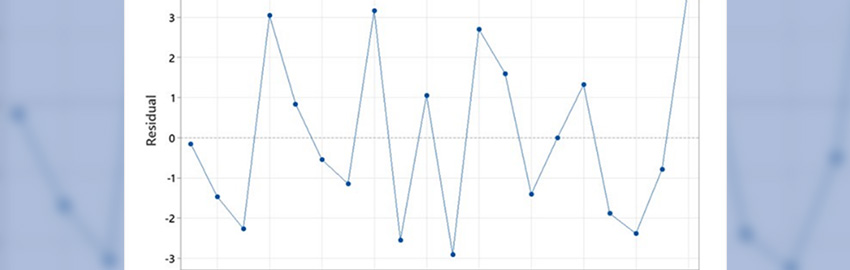

Interesting analysis can be derived from some of these data, as explained by a presentation at the annual IMAPS International Symposium on Microelectronics in October in San Diego. As noted by Jawbone, a maker of fitness tracking devices and other wearables, wristbands monitoring sleep activity captured the timing and range of the September earthquake in Napa, CA.

Privacy concerns abound and may limit data collection, transmission and storage. A Hewlett-Packard study from last summer found that over 70% of connected devices have serious vulnerabilities,3 including encryption, password, cross-site scripting, user access, and permission. Some analysts assert this is a concern for IoT devices that share information and create alerts. This includes patient data involving medical conditions or home thermostats that could indicate when a homeowner is away.4

IoT: Something new? Does IoT mean totally new products? Yes and no. Obviously it means more sensors, wireless chips and processors. Of course it includes existing mobile devices such as smartphones and tablets, and emerging wearable electronics products such as activity monitoring cameras, wrist products, and other clothing, and it probably includes devices not yet dreamed up. It would be a mistake to add the projected IoT units to the existing projections for appliances, smartphones and other devices. While some of these wearable electronics products are new, smartphones and tablets already exist. Home and office thermostats, appliances, and other physical products exist, but might be replaced by new smart ones.

IoT potentially means increased data communication, storage, computation and transmission back to the user. This will likely increase demand for servers and data storage products beyond the typical projections of the past.

Electronics industry impact. How will this grow the electronics industry? Several keynote presentations during IMAPS provided insights. IPDiA described the role of advanced integration and packaging technologies for the miniaturization of medical devices, especially the role of integrated passives. Growth means mobile devices will remain a key contributor to the overall total unit volumes and packaging, and assembly is an enabler.

What type of package will benefit from an IoT explosion? Qualcomm explained that the variety of packages that will continue to be used in mobile devices is staggering. It includes not just wafer level packages (WLPs), including fan-out WLPs and flip-chip devices, but also wirebond packages. New low-cost packages that make use of leadframes combined with flip-chip are also expected to see increased demand, thanks to relentless cost pressures. With so many choices, the challenge is selecting the correct package for each device to provide proper performance, form factor and function. The story is no different in examining many of the new wearable electronics products. Packages include BGAs, fine-pitch BGAs, flex circuit CSPs, land grid arrays (LGAs), including multichip modules, chip-on-board, stacked die CSP, package-on-package, leadframe packages such as quad flat no-lead (QFN), small outline package, and thin small outline package (TSOP), ceramic packages, wafer-level packages, and integrated passive devices. Future packaging options include FO-WLPs, a variety of routable leadframe packages, and system-in-packages (SiPs). No single package dominates this category, but increased cost sensitivity will place greater demands on package and assembly decisions.

Growth in the demand for servers means continued evolution of the packaging and assembly for high-performance systems. A presentation by IBM focused on high-end package developments, tracing the evolution from ceramic to laminate packages in servers. Silicon interposers are one potential package for high-performance devices found in servers and network systems. The trend to finer-pitch devices will drive the use of Cu pillar instead of conventional C4 solder bumps for interposers and organic packages. Assembly issues such as warpage, voiding with the use of underfill, higher performance thermal interface materials, and testability remain concerns. Improvements in high-accuracy bonders, including thermo-compression bonding, will be needed. Companies such as K&S discussed new bonder developments at the meeting.

Clearly, high-performance memory will be required for future systems. Examples of memory packaging, including the recently introduced 3D IC format for high-performance applications, were detailed by Micron. Introductions of 3D IC memory from SK Hynix and Samsung are equally important in developing systems for the future.

Myth or reality? Clearly, much hype surrounds discussion of IoT growth, and the unit volumes projected need to be kept in perspective. The IoT is not an additional category of products, but the culmination of greater connectivity in mobile products that will be enabled by improved high-end computing and communication systems. As long as privacy issues can be addressed, the increased connectivity of many products has the potential to provide useful analysis for individuals, businesses and governments. Wearable electronics alone do not represent sufficient volumes to dictate the development of specialized packages, but instead rely on the designer to select from the wide variety of packaging options. Assembly and packaging developments underway will clearly benefit the size and performance of future products. The reality is there are lots of “things” that can make use of the Internet; some are known products, and others are yet to be invented. Design, packaging and assembly are the enablers of these imaginative products.

References

1. L. Spencer, “Internet of Things Market to Hit $7.1 trillion by 2020: IDC,” ZDNet Insights, June 5, 2014.

2. U. Shankar, “IoT & The Age of SCM 2.0 Enhances Supply Chain,” Electronics Business News, June 24, 2014.

3. Daniel Miessler, “HP Study Reveals 70 Percent of Internet of Things Devices Vulnerable to Attack,” July 29, 2014.

4. A. Justice, “IoT Soup: Four Ingredients for a Successful Smart Product,” ECN, Oct. 6, 2014.

E. Jan Vardaman is president of TechSearch International (techsearchinc.com); This email address is being protected from spambots. You need JavaScript enabled to view it.. Her column appears bimonthly.