IRVINE, CA -- MFlex reported fiscal second quarter net sales fell 32% year-over-year to $117.8 million as sales to its largest customer plunged. The net loss widened to $52.4 million, down from a loss of $23.9 million in the prior year.

The flex circuit maker took $29.8 million in one-time charges during the March quarter, $24.8 million of which were pretax charges for building and equipment write-downs, plus $13.1 million in cash.

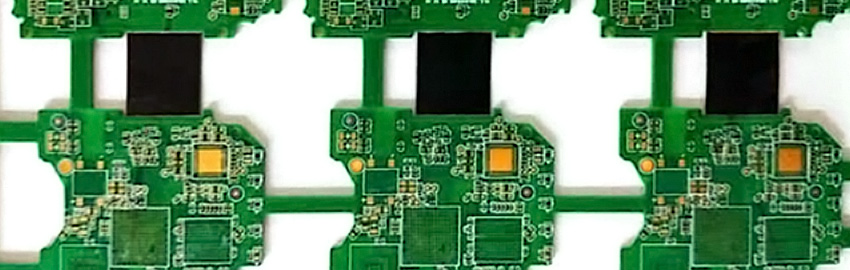

The company generated $14.9 million in cash flow from operating activities during the quarter. Gross margin was -11%, down from -8.9% a year ago, when the firm took a $10.9 million inventory write-down. Smartphones (74%), tablets (11%) and consumer electronics (10%) made up almost all MFlex's sales.

MFlex has risen and fallen on the backs of two companies, the largest of which is Apple, which made up 75%, 74% and 44% of the company's net sales in fiscal 2013, 2012 and 2011, respectively. During that same period Blackberry made up 11%, 16% and 42% of Mflex's sales.of $124.6 million at March 31, 2014. The Company continues to maintain a strong balance sheet with no debt. MFlex did not identify by name the company responsible for the lower March quarter sales, but said it accounted for 43% of net sales during March quarter, meaning it is likely Apple.

The loss obscured gains in net sales to others customers, which increased $39.4 million to approximately $53.6 million. Net sales to the newer customers represented approximately 46% of total net sales. Two of these newer customers were each at or above 15% of net sales during the quarter.

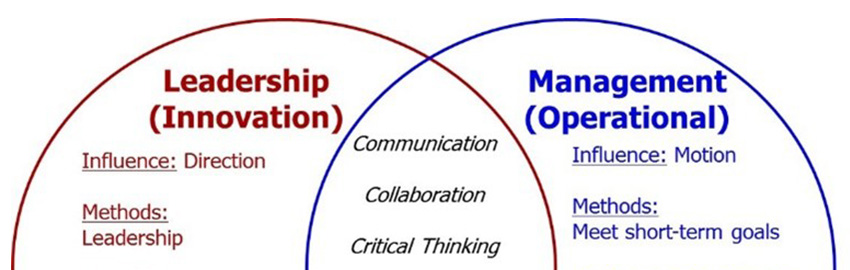

In a statement, chief executive Reza Meshgin said, "Our restructuring plan is proceeding as expected. We are in the process of closing our engineering and research & development subsidiary in theU.K. and have ceased assembly operations in Chengdu, China. We plan to transfer certain research & development activities to our facilities in the U.S. and China. We are on track to complete the restructuring activities, including the consolidation of assembly operations from Chengdu and our two satellite manufacturing facilities in Suzhou, China into our two main manufacturing plants, MFC2 and MFC3, in Suzhou by the end of June. Based on our expectation that we may be able to sell some assets held for sale at a higher price than initially anticipated, we expect our total impairment and restructuring charges to be at the low end of the $40 million to $60 million range initially provided. We continue to expect annual cost savings of approximately $50 million."

MFlex guided for June quarter sales of $115 million to $130 million and a gross margin of -5 to -6%. "With our expected cost savings on track, we believe our improved cost structure will support sustainable profitability and competitiveness," Meshgi said. "Based on the timing and breadth of new programs expected to ramp across our customer base, we continue to anticipate a significant increase in net sales and a return to profitability, excluding impairment and restructuring, in the fiscal fourth quarter."