-

Bend Days

A bend radius lower than the recommended minimum merits a closer look. READ MORE...

-

The Experts' Take on AI

What’s working now and what’s not (but should be).

READ MORE... -

Are You Using Too Many Vias?

The answer is probably yes. READ MORE...

-

Designing for High-Pin Count Devices

Overcoming “anywhere but here.” READ MORE...

-

PCB Stack-up and Signal Integrity Fundamentals

How to order layers to achieve target impedance values. READ MORE...

-

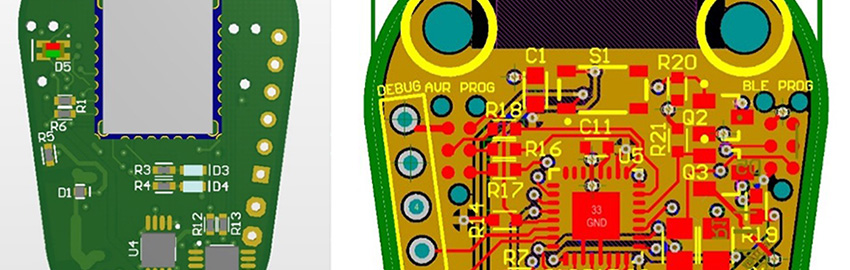

Bluetooth Design

6 steps for limiting interference and data loss. READ MORE...

-

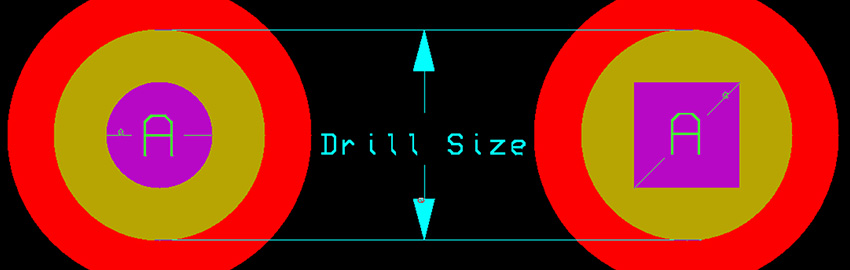

Component Land Patterns

A manufacturer’s perspective on determining parts layout. READ MORE...

Homepage Slideshow

Bend Days

A bend radius lower than the recommended minimum merits a closer look.

The Experts' Take on AI

What’s working now and what’s not (but should be).

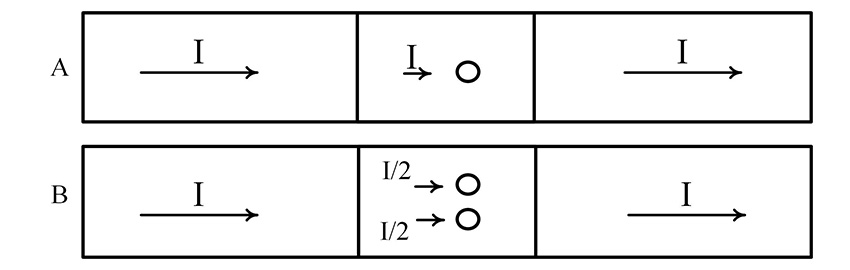

Are You Using Too Many Vias?

The answer is probably yes.

https://www.pcdandf.com/pcdesign/index.php/editorial/menu-features/18713-are-you-using-too-many-vias

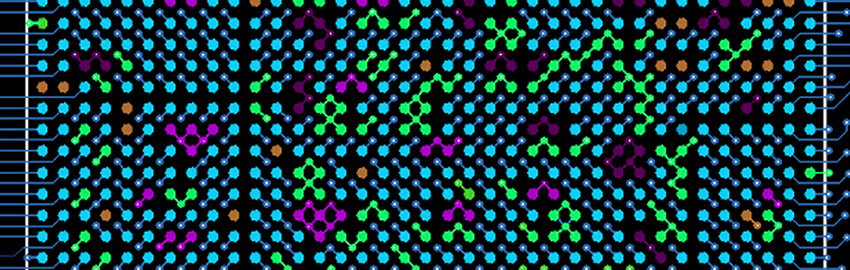

Designing for High-Pin Count Devices

Overcoming “anywhere but here.”

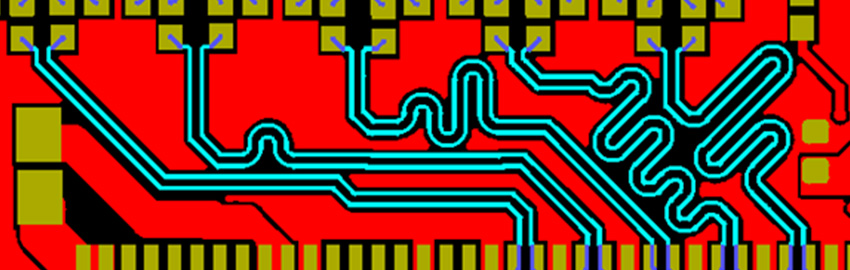

PCB Stack-up and Signal Integrity Fundamentals

How to order layers to achieve target impedance values.

Bluetooth Design

6 steps for limiting interference and data loss.

Component Land Patterns

A manufacturer’s perspective on determining parts layout.