Is the needle moving from free trade toward protectionism?

The well-being of the American worker has taken center stage this summer, with competing economic proposals likely to be volleyed back and forth throughout the presidential debates this fall. American OEMs will be listening intently for potential shifts in government policies as they apply to their current EMS planning strategies.

China, Mexico (and the “wall”), immigration policies and trade deals are part of the stump speeches of all the major candidates. A proposed border wall could be built to keep out immigrants from the south. Trade deals both old and new such as NAFTA and the Trans-Pacific Partnership (TPP) could be renegotiated or voided. Accusations of currency manipulation – long part of the political chatter – could evolve into real action.

Both major party candidates for president in the US have pledged to renegotiate the nation’s major trade deals. Proposed changes would include applying import duties on supplier nations; pressuring American companies that have relocated their factories abroad; addressing trade deficits; and penalties for currency manipulation.

The goal in all cases is to bring manufacturing jobs “back” to America. And by Nov. 9, 2016, Election Day in the US, it is likely some change will be coming to the US’s import duty policy.

Changes to the longstanding US position of free trade to a more protectionist approach will have significant ramifications for multinational businesses or supply chains. These issues are hardly exclusive to the United States, however. Europe faces many similar situations, starting with Great Britain’s voter-approved “Brexit” and the staggering numbers of displaced Middle Easterners and Northern Africans who are as much in search of basic shelter as economic opportunity.

The pushback has been fierce, and the implications sharper still. Although Great Britain’s referendum to sever certain trade requirements of the European Union was influenced by an anti-immigration movement, it also marked an anti-globalization sentiment driven by a lack of jobs in England. No sooner was the Brexit vote completed that the impact brought immediate chaos to the stock markets, driving down the value of British currency and dropping the nation’s global economic ranking a full spot. The long-term impact to England’s economy is unknown.

Brazil’s long-term protectionist policies have caused it to remain isolated in the global marketplace. Foreign traders have essentially eliminated Brazil as a desirable business partner.

Even China is feeling the effects of constantly increasing taxes on foreign companies. Foreign companies are exiting China, leaving fewer investments (and possibly manufacturing) in the country.

The very important considerations of free trade vs. protectionism have long-term effects that remain in question. While the goal of solving national shortages of jobs is admirable, the lack of robust dialogue can mean overlooking potential side effects a major shift in trade policy can bring. Nevertheless, it appears the US and Great Britain, to name two, are headed down this path full speed.

From a corporate perspective, most OEMs and their supply chains are not interested in the politics or economics of multinational trade deals. Rather, they want to know the ground rules, and to feel some confidence that, whatever deals are struck, the playing field is level and they will have fair access to their desired markets. Stability is highly desirable. There’s a real cost that comes every time the rules of business change.

If trade becomes less open for businesses, what will the levels of adjustment needed be? Will they be drastic, moderate or just token? We need to watch if the US’s push to mitigate trade imbalances with China and Mexico will trigger similar measures in other regions. Will South Korea, Taiwan and others increase import duties? And what about America-friendly countries such as the Philippines, Singapore, Malaysia, Indonesia and India? How would an exit from the TPP impact the long-term welfare of the US? These complex scenarios will unfold and formulate challenges in 2017.

What’s Next for America’s OEMs?

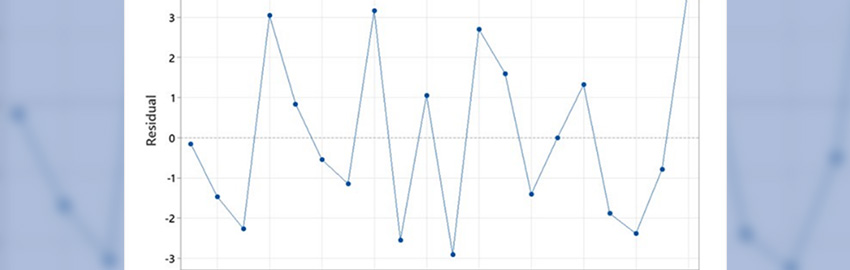

Total acquisition cost, or TAC, is derived as a combined function of technology needs, production quality, labor content, shipping cost, IP content, personnel travel and import duty. TAC is a key metric for the electronics supply chain.

The TAC differential between products made in Mexico and those made in the US is not significant. Hence, for certain products the case can be made to shift manufacturing to the US.

With moderate increases in import duties for China-made products, it is likely OEMs will be compelled to move most of these products to the US, as the TAC differential between China and the US is appreciable. However, numerous Asian countries also serve as a strong alternative to China. It is likely these Asian alternatives will benefit much more than the US.

With duties on Mexico and China imports looking likely, we are witnessing a new trend in US trade policy. For now, the time is right for OEMs that rely heavily on Mexico and China for lower cost assembly to reevaluate their EMS strategies, as the likelihood of import duty increases will launch a new era in the global EMS marketplace.

Joseph Fama is a senior executive with extensive experience in the global EMS marketplace, 25 years with Singaporean, Chinese and U.S EMSs and systems companies. He is currently serving as vice president – sales and marketing at Ionics (ionics-odm.com); This email address is being protected from spambots. You need JavaScript enabled to view it..