IPC: EMS Execs Remain ‘Very Concerned’ about Covid-19 Impact

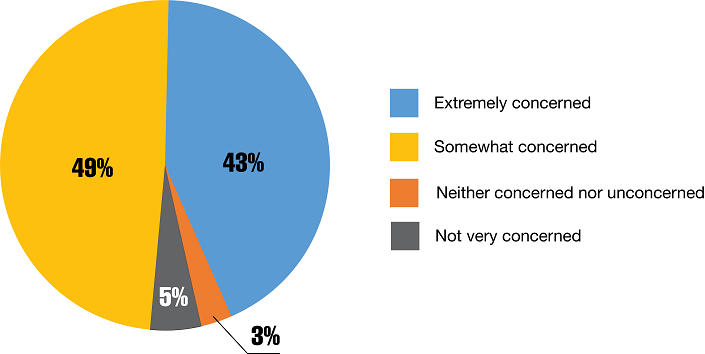

BANNOCKBURN, IL – Electronics manufacturing executives remain very concerned about the impacts of Covid-19, according to a recent survey by IPC. Some 43% of executives who replied to IPC’s latest online poll said they were “extremely” concerned, and 92% were “somewhat” or “extremely” concerned. Only 8% were neutral or unconcerned.

As health officials around the globe struggle to “flatten the curve” of coronavirus cases, the electronics manufacturing industry continues to face ambiguous operating restrictions, uncertain economic conditions, abnormalities in supply chains, and greater gaps in the workforce, according to IPC.

Over the past week, IPC has continued to monitor the health of the electronics manufacturing industry amid the Covid-19 pandemic, including an ongoing series of calls with member company executives.

Medical equipment production is ramping up. Some companies are reporting they have stopped making their usual products to produce inputs for medical equipment. According to IPC’s most recent online poll, roughly 7% of companies have stopped production of other equipment to create capacity for medical equipment.

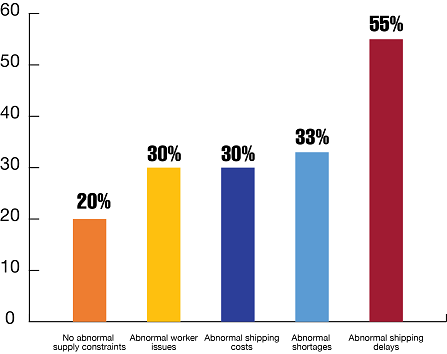

Companies continue to face a myriad of abnormal conditions. Eighty percent of executives who responded to IPC’s online poll reported a variety of supply constraints as a result of the coronavirus outbreak. Some 30% of respondents reported facing abnormal workforce issues; 30% reported abnormal shipping costs; 33% reported abnormal shortages; and 55% reported abnormal shipping delays. Roughly one in five executives (20%) reported they are facing no abnormal supply constraints.

Slowing demand is slowing manufacturing output. Some companies report they haven’t felt any pressure to ramp up production back to full capacity in China or elsewhere. Some believe demand will return by the second half of 2020, but there remains significant uncertainty.

Some companies report they are not stockpiling supplies or buying ahead because “cash is king” in the current environment.

Hardship and retention bonuses are appearing. Executives report a variety of approaches to employee compensation. Some companies are offering “supportive” or “supplemental” pay, with the recognition this is a more difficult time for some employees. Other companies report they are offering bonuses later in the year, when cash flows will be more certain, for employees who continue to show up throughout the crisis. Some companies are paying workers double-time immediately if they’ve worked more than 48 hours a week. Some companies are reporting bonus programs for the next 90 days to ensure they can retain critical mass within certain areas of the business.

Some companies report they have workers on temporary leave (furlough) as work has dried up. The challenge is guessing what demand will look like after the worst of Covid-19 passes, and how many workers they will need versus possible layoffs of staff.

Some companies report their customers have strong backlogs, and they expect demand to improve as we emerge from the worst of Covid-19. Companies in the defense sector continue to report orders are flowing, without signs of weakness.

Companies report they continue to have a strong focus on employee safety. Some report they are convening their safety committees as often as daily to address any issues.

Winchester Interconnect was selected by General Motors to help manufacture Ventec ventilators. The company faced several issues as they ramped up, including tooling availability and lead times. They needed to borrow and rent applicators for two to four weeks while they waited for purchased units to arrive. IPC shared that request with the industry at large. Three different manufacturers and five different part numbers were involved, but the need was met within one day.

“This is the kind of opportunity where we can come together as a community,” said IPC president and CEO John Mitchell.