Mentor Calls Icahn Plan "Risky, Potentially Destructive'

WILSONVILLE, OR -- Saying disgruntled shareholder Carl Icahn "has no stated strategy," Mentor Graphics yesterday urged other stockholders to reject the activist investor's slate of board candidates.

In an SEC filing, the EDA company said Icahn's acquisition proposal is "run on a singular risky platform of selling Mentor without any other stated vision or specific strategy," and that his nominees "do not have the collective knowledge, skill and experience of Mentor’s current board. Instead, the company argued that its financial track record, coupled with the lack of a suitable merger partner, mean its current strategy is the best direction available.

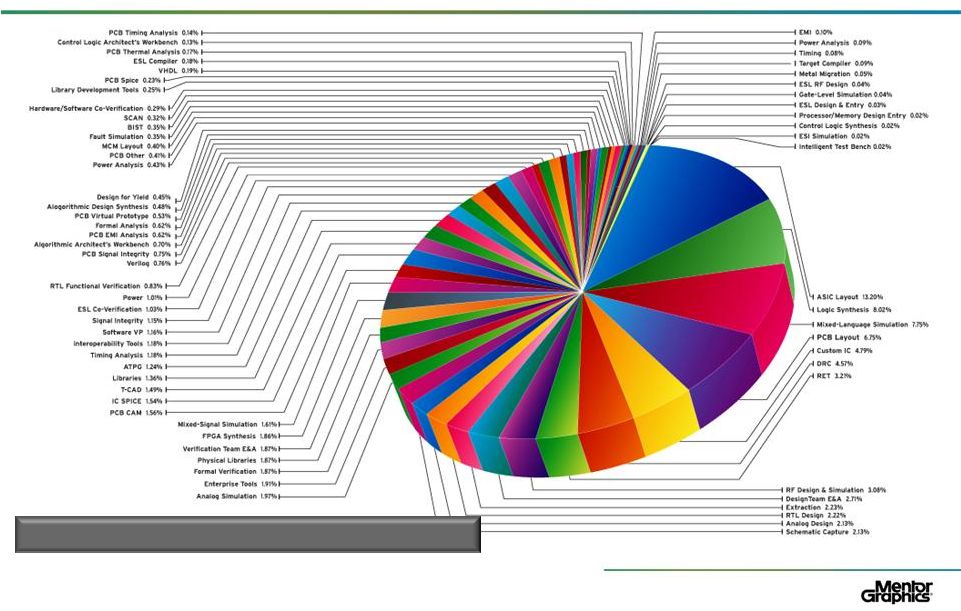

The filing is the latest salvo in the war of words over the printed circuit board and semiconductor design software developer. In the filing, Mentor portrayed itself as a complex entity with product offerings in a slew of niche areas (see pie chart below, or click here for a larger version). It noted data from Gary Smith that puts Mentor as the leading supplier in each of the PCB tools, design for test, design rules checks, and RET segments, evidence, the company says, that its board is executing on its plan. The company says the segment leader historically gains share at the expense of others, and this drives exponential profitability.

Mentor said two of the three directors proposed by Icahn lack the necessary industry background to compete in the PCB and semiconductor design market, adding that the third, the former president and CEO of Synplicity (now part of Synopsys), oversaw average SG&A expenses that were "well above" Mentor's. Mentor has been accused by Icahn and fellow investor Casablanca Capital of fostering a "country club" environment, to the detriment of shareholders.

Icahn, who has a long history of hostile takeovers, believes Mentor is wrongly asserting that a sale of Mentor would run afoul of US anti-trust laws, and insists the company management has "sabotaged" opportunities to unlock greater returns for its shareholders. He currently owns 14.7% of the company, making him the largest shareholder. A poison pill proviso essentially prevents Icahn from acquiring a larger stake in the company.

Mentor has repeatedly asserted regulatory risks persist over Icahn's proposed $1.9 billion takeover. In the filing, it noted the potential dominant market share if merged with Cadence or Synopsys. However, as some analysts, including this magazine, have pointed out, that defense rests on assuming a very small universe of two possible merger candidates, and ignores potential interest from PTC, Siemens, National Instruments and other major companies.

[Right click image to see larger version]