The Asian Persuasion

The annual rankings of the world’s largest PCB fabricators are, once again, dominated by Southeast Asia.

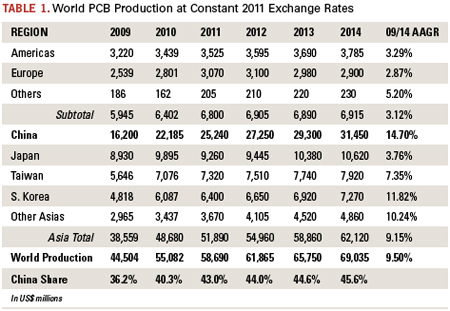

Worldwide printed circuit board output grew 23.8% year-over-year in 2010, fueled by – where else? – China, which grew 37%. Considering the ongoing and near-term expansion taking place in China, the nation’s PCB output will outpace all other regions per Table 1. The 102 largest (by revenue) fabricators produced approximately 80% of the total worldwide output in 2010. As we’ve noted many times, there is a clear trend that the bigger companies grow faster than the smaller ones.

In this annual report, we present a list of world’s top 102 PCB makers in 2010, and discuss their trends by analyzing the data from various angles.

Unlike previous years, we did not separate flexible printed circuit assembly (FPCA) from the totals because it is very difficult to separate the assembly values from the total output of those fabricators. Most large flex circuit fabricators generate a major portion of their revenues from assembly, however.

Also, some major mergers and acquisitions took place during 2010. Regardless of the dates of acquisition, these activities are assumed to have taken place on Jan. 1. Finally, the fiscal years of AT&S and most Japanese fabricators ended on March 31.

Exchange Rates

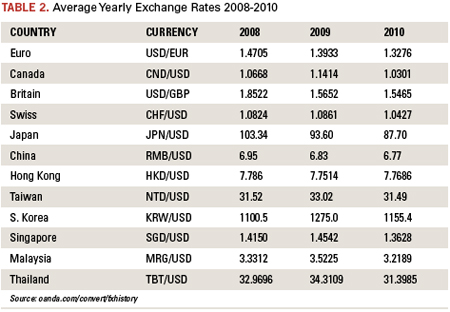

Exchange rates play a major role in the rankings. Taiwan manufacturers seem to convert their NT dollar-based output to US dollars every month. In this report, the author used “average exchange rates” to convert output in local currencies into US dollars for comparison purposes, as listed in Table 2.

The output reported by some Chinese makers included value-added taxes (VAT), which have been deducted. Moreover, close to 1,500 factories in China are operated by more than 1,100 manufacturers. As the author is not fluent in Chinese, he may have missed some important manufacturers that own multiple factories under different names. Every effort will be made to improve the data through better understanding of Chinese makers. Revenues of some manufacturers such as Foxconn (FAT) are based on calculated guesses, because the company does not break out its revenues. (If you know, please inform the author.)

Finally, keep in mind the rankings are “relative,” not “absolute.” If readers are dissatisfied by the rankings in the tables, please make your own corrections and judgment. Also, the author made maximum efforts to present as accurate a number as possible, but given human fallibility, there may be some errors. Please excuse the author for any errors, for which he takes full responsibility.

Summary of Top 102

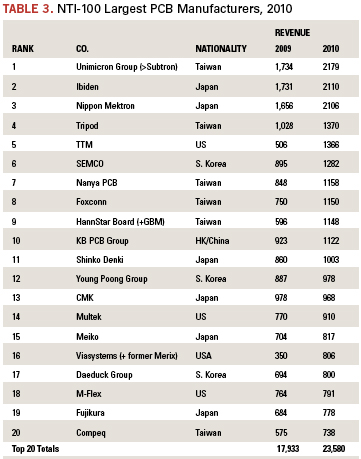

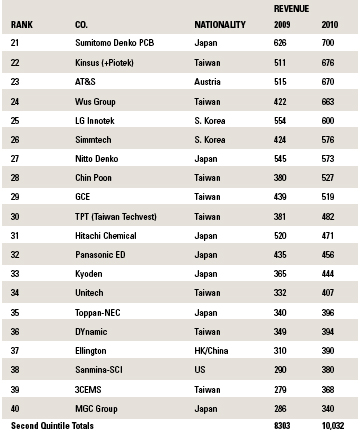

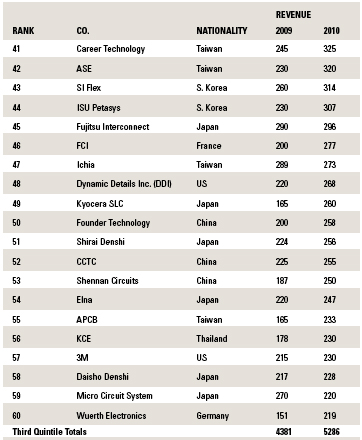

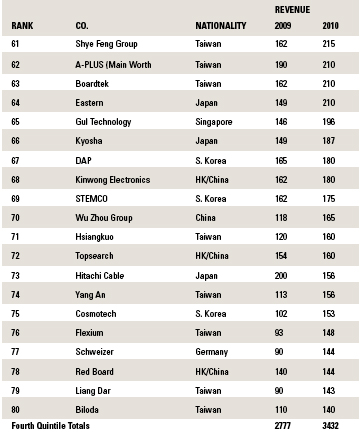

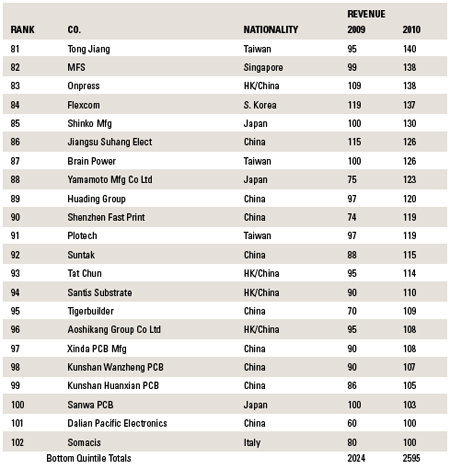

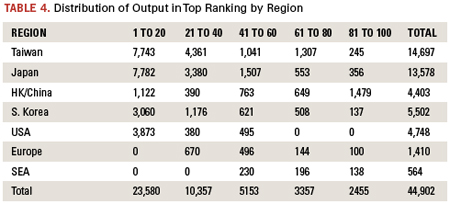

In 2010, a total of 102 companies had PCB sales of $100 million or more (Table 3). Total (domestic and overseas) production by Taiwanese PCB makers in 2010 is estimated to have been $17 billion, while No. 2 Japan topped $14 billion. These two countries accounted for 56% of the world production. Table 4 shows why. Their respective investments in China and Southeast Asia in fiscal 2011 will amount to approximately $2.5 billion, which puts these two countries in position to continue to dominate world production.

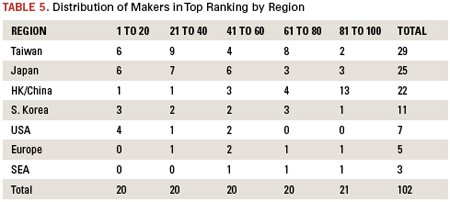

Hong Kong and Chinese fabricators are moving onto the list quickly, as one can see from Table 3 (an aggregate $1,379 million in the bottom quintile) and Table 5 (13 entries).

US-based fabricators actually build more boards offshore than they do in the US. To wit, it took about 320 US fabricators to produce $3 billion in 2010 domestically, while just six US-based fabricators (TTM, Viasystems, Multek, M-Flex, Sanmina-SCI and 3M) produced some $3.1 billion overseas. Because of their vigorous investment overseas, offshore production by US-based manufacturers will continue to grow, while domestic production will oscillate around the $3 billion level.

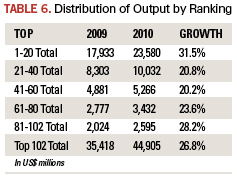

Table 6 underscores the “big get bigger” trend. At the same time, the growth rate of smaller manufacturers ($80 million to $150 million per annum revenue) is greater than their middle-class counterparts. This is driven by the China-based manufacturers, while mid-tier fabricators in “the west” are stagnant in terms of revenue growth. Big fabricators continue to expand because their big customers do not wish to increase the number of suppliers. Small ones have no fear. Middle-class makers are sandwiched between these two classes.

Dr. Hayao Nakahara is president of N.T. Information; This email address is being protected from spambots. You need JavaScript enabled to view it..

Ed.: Due to last-minute changes in the data, the original posting of this article indicated 101 fabricators had sales of $100 million or more in 2010. In fact, there were 102 such companies. PCD&F regrets the confusion.

Follow us on Twitter: @mikebuetow