RoHS in the Hi-Rel Market

New testing methods offer non-destructive confirmation of component composition.

The words "lead-free" and "RoHS compliant" frighten those responsible for building electronics for industries exempt from current lead-free regulations - aerospace, medical devices, the military, power generation equipment and other long-lived capital tools. As the consumer electronics industry moves away from the use of lead in electronic components, boards and solder, so follow the manufacturers of these supplies. For the most part, the size of the consumer electronics market dwarfs the demand of the exempt industries in terms of quantities and dollar volumes. This leaves manufacturers of high-reliability equipment with dwindling supplies of the "high reliability, lead-containing" components their products require.

Generally known as the high-reliability or hi-rel market, the affected industries are facing many challenges from the changes brought about by the European Union's Restriction on Hazardous Substances, or RoHS1.

The good news for some is that exemptions from RoHS were included for a period of two or more years for certain industries where suitable replacements have not yet been found. These exemptions include the hi-rel markets mentioned above, since the long-term performance of lead substitutes has not yet been qualified. These exemptions will expire as the materials science moves forward with more suitable substitutes and their long-term reliabilities can be confirmed.

Despite the reprieve granted by the exemptions, there are several issues caused by the shift away from these materials, affecting both consumer electronics manufacturers and hi-rel manufacturers. There are also problems that emanate indirectly from the impact of RoHS on the supply chain.

Users who must currently meet the restrictions, particularly OEMs, system-level manufacturers, and their direct sources of components and materials, are moving through massive shifts in their manufacturing processes. By contrast, exempted companies are finding a different type of issue arising: the reliability of the elemental make-up of items that are not officially controlled by the regulation. It has been said that certifications of incoming material are often unreliable, that mix-ups between RoHS-compliant and leaded parts is rampant, and that as much as 30% of the material received is mislabeled. There is a real potential for problems resulting from this situation for both the RoHS compliant manufacturing organization, as well as the exempt manufacturer.

This problem has led many to follow Herbert Hoover's maxim to "trust, but verify." Even a supplier to an OEM can lose important accounts if the customer cannot rely on the integrity of the parts shipped. Thus, at every point in the supply chain, seller and buyer are urged to communicate on the issue of material integrity, and to discuss how both parties can ensure that parts needing to be compliant will be. This is important for both parties, for their future revenue streams and for access to the EU marketplace.

Therefore, direct testing of incoming parts and materials is an important element for all users of electronic components and materials. Almost all organizations are either under RoHS today, or will be in the near future. Hi-rel manufacturers need to confirm that parts have the correct material makeup, or risk field failures. The directives from the EU recommend using a combination of handheld and benchtop x-ray fluorescence equipment to identify problems before they go too far in the production process. These scientific analyzers-turned-industrial tools give point and shoot results, with accuracy needed for most leaded and RoHS-compliant testing. A portable version look like a cordless drill and tests an area the size of a nickel (Figure 1). The benchtop unit, on the other hand, has a narrower testing area that provides the advantage of testing a smaller, more specific area. These instruments are not magic wands, but used correctly as part of a testing program, they provide production friendly, non-destructive material screening.

|

Screening is a key testing element to keep throughput high while confirming that the materials in your process are as required - either leaded or lead-free. Screening involves appropriate sampling, and comparing to known and expected results on those parts and in those areas at risk. To identify every homogeneous material within your circuit boards, testing the components and materials may appear to be a sound approach, but it is neither cost effective nor necessary. Because the RoHS regulation is written for something you don't usually have (a homogeneous substance), you need to develop methods for "smart screening" using the available tools to look at the mixed materials you do have - alloys, plastics and ceramics, and obtain a usable result.

The goal of smart screening is to weed out potential problem materials by using the low-cost, high-throughput handheld XRF unit, so that testing is quick, non-destructive and does not impede production. This allows you to go back to your suppliers, work with test labs or go to the benchtop unit with micro-focus only on the parts with a potential problem. Implementing the use of smart screening using a handheld unit will provide more time to undertake localized testing of questionable parts.

RoHS - the Backstory

In the 1990s, the electronics industry came under significant pressure to abandon the use of lead based on research showing its effect on humans, particularly children. At the time, the use of lead had been eliminated in automobile fuel, and electronics was one of the remaining users with a growing demand for the heavy metal. Even though the circuits themselves were shrinking, and the amount of metals in electronics was falling dramatically, the number of "personal electronics" was increasing significantly in absolute terms.

Europe, with its high population density, had run out of landfill space and was burning much of its trash. Electronics was a growing portion of the waste stream, and their incineration put toxic materials from electronic waste into the air, creating an air pollution issue. Additionally, the permanent toxins could be carried into the soil and inexorably end up in the food chain.

The EU was pressured for a solution as these health risks became known to the public. Large industrial companies whose products eventually ended up in the waste stream, aware that legislation was likely, had also been studying the issue and looking at alternative manufacturing and testing methods. All this activity ultimately led to the creation of legislation restricting the use of those substances deemed to be most toxic and most readily removable from the manufacturing processes. The result was RoHS, which went into initial effect July 1, 2006.

The Hazardous Substances

The restrictions cover bromine (Br, in two specific forms), mercury (Hg), chrome (Cr, in one specific form), cadmium (Cd) and lead (Pb). Bromine is generally used as a fire retardant in plastics, and the metals are used in various applications in both plastics and metal parts. Concentrations are not to exceed 1,000 parts per million for all but cadmium, which is limited to no more than 100 parts per million. These restrictions apply to "homogeneous substances," meaning individual materials. A single chip may have a dozen materials or more in its makeup, but it is not the percentage of lead or mercury out of the entire chip that matters - it is a question of how much is in that lead frame, solder or trace that determines compliance. This single distinction drives companies towards the test programs discussed above.

It has proven difficult to learn the concentrations of the pure substances within a mixed item without significant preparation for testing, such as micro grinding into the homogeneous materials. The original maker of the raw materials can easily and cheaply test for, and confirm, compliance with the regulations. However, they do not have liability under the directive; it is the end manufacturer/exporter of the final product (IBM, Sony, Garmin, etc.) who can be fined and potentially lose their ability to export into the European market if they fail to comply. And yet, a complex, assembled product is the most difficult to confirm as "in compliance." It takes a thoughtful compliance program and some common sense to reduce risk.

Shaving those Tin Whiskers

The move away from these materials has caused a scramble to find replacements. In some cases, no easy or low cost direct replacement is possible. Hexavalent chrome (Cr+6), for example, has been difficult for manufacturers to replace, since other forms of chrome are not as effective at their intended job as the hexavalent version. Some manufacturers are moving away from chrome coatings entirely, using costlier solid stainless steel or other substitutes.

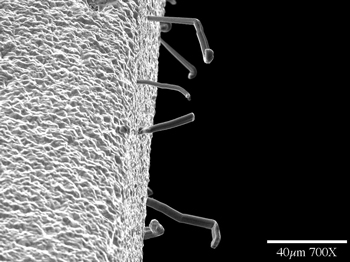

In the case of removing lead from solder, one risk of the alternatives is compromising system reliability. In amalgam with tin, lead's melting point traces a eutectic, meaning the alloy of the two elements generally has a lower melting point than either of the components alone. More importantly, when mixed with tin to at least 3% of the alloy, lead prevents the tendency of tin to grow "whiskers," tiny hair-like crystals that seem to grow out of the surface.

In general, product failures caused by tin whiskers are due to shorting, either by direct connection of a contact at voltage to ground, or when a whisker breaks off and creates a short elsewhere in the system. Conformal coating and other techniques have been shown to reduce, or at least slow, these effects. Another lesser concern is "tin pest," in which tin solder without trace amounts of antimony can slough layers of tin dust, ultimately leading to field failures.

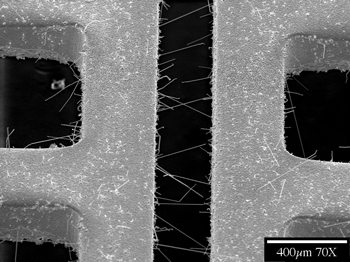

Since the push for the removal of lead, there has been an increase in research to understand the tin whisker phenomenon, and several researchers have built advanced theories on the causes of them. Peter Bush, who heads the analytical research lab at the University of Buffalo, has done long term studies in an effort to model the behavior of lead-free solders in various environments over time. Micrographs of tin whiskers from Bush's work are seen in Figure 2 and Figure 3.

|

|

The main class of alternative solders is generally known as SAC solders, after their components, which are mainly alloys of Sn (tin), Ag (silver) and Cu (copper). These solders appear to provide the best combination of workability and resistance to problems such as whiskering. However, at this time, new solders are not considered sufficiently tested for applications where longevity is absolutely critical. These include space flight and satellites, certain medical implants and devices, and in certain long-lived capital equipment.

One of the main reasons for the extraordinary cost of the changeover (estimated to run as high at $100 million) is that the SAC solders generally require a higher solder temperature. While 20öC sounds low, the impacts are enormous - from the effect on the components, boards and sensitive chips being soldered, to the new production lines required for the higher temperature soldering methods. The scale of the engineering work required for global compliance is astounding.

One Europe - Still a Distant Dream

Getting ready for RoHS is like packing your suitcase without knowing if you are going skiing or to the beach. Europe is not one market as far as RoHS is concerned. Each member state is responsible for moving the RoHS regulation, drafted by the EU legislature, into the laws of their own country and are subject to the variations of each nation's complex import/export regulations, customs, environment and laws. The EU member states have not uniformly adopted the regulations, but are all implementing compliance checking in various ways with the potential for differing interpretation of the regulations.

The supply chain, from raw material mining and manufacturing to component houses, distributors and brokers, are struggling to deal with the uncertainty of the regulations, questions about where responsibility and liability rest, and conflicting answers or lack of answers from the various governments of Europe. This uncertainty has created problems for the entire supply chain; interpretation, projections on the basis of past environmental regulations and conjecture have been the only solutions companies have at this time. Once compliance moves into full swing, we will have case laws, directives, clarifying notices and more experience with this complex set of rules. At the moment though, companies are relying on advisors, consultants, lawyers and others who may be more adept at figuring out the implementation of the regulations. PCD&M

Drew Hession-Kunz is vice president of business development at Innov-X Systems; This email address is being protected from spambots. You need JavaScript enabled to view it..

REFERENCES

1. RoHS pronunciation is still not standardized, and creates some confusion when discussed using the varying ways to say the name. Some say "Rose," or "Row-hoss," or "Ross." In our office we say "Ross," but I have seen a movement in industry now toward "Row-hoss." However you say it, listen for the other pronunciations, so you know what everyone is talking about!